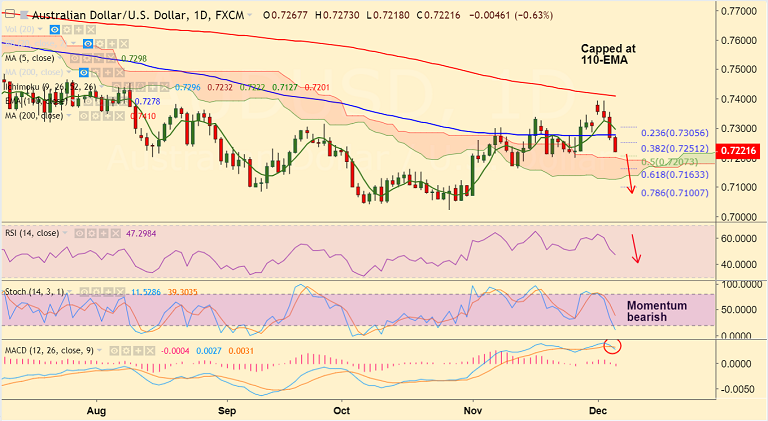

AUD/USD chart on Trading View used for analysis

- AUD/USD eyes 0.72 handle as the pair is extending declines after unexpected miss in Australia's Trade Balance.

- Australia’s trade surplus narrowed to A$2.3 billion in October from A$2.9 billion the previous month.

- Exports remained static but imports surged, rose 3% following -1% in September while exports were steady at +1%.

- Traders largely ignored positive retail sales which were up 0.3% m/m in Oct versus a +0.2% forecast and accelerating from the +0.1% in Sept.

- The pair has slipped below all major moving averages. Is on track to test next major support at cloud (0.72).

- Technical indicators have turned bearish. Stochs and RSI sharply lower. MACD is showing a bearish crossover on signal line.

- Break into cloud will see further weakness. Retrace above 110-EMA could see some upside.

Support levels - 0.72 (cloud), 0.7163 (61.8% Fib), 0.71 (78.6% Fib)

Resistance levels - 0.7251 (38.2% Fib), 0.7278 (110-EMA), 0.7298 (5-DMA)

Recommendation: Good to go short on rallies, SL: 0.7280, TP: 0.72/ 0.7165/ 0.71

For details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays