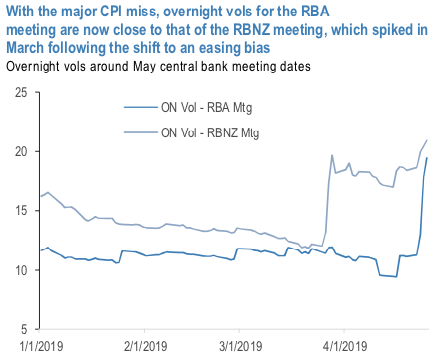

The canter of attraction is that the Antipodeans heading into early May, with both central banks in play on consecutive days on 7/8 May. The AUD short is well-placed now that we have brought forward our projection for two RBA cuts from July-August to May-June following last week's downside surprise on core inflation which saw the annual rate dragged further below the lower end of the target band.

The market, we believe, underprices the risk that the RBA front-loads easing in this way (only 90% of rate cut is priced), and as such we believe there is scope for further attrition in the currency even though the back-end of the curve is toying with the idea of a sub-1% terminal rate.

This emphasis on the domestic rate cycle should weaken any support for AUD either from elevated bulk commodity prices or the lift in Chinese growth, especially as the external demand spillover from tax cuts will be weaker than previous rounds of stimulus which tended to be channeled more directly through infrastructure spending.

We are inclined to boost our AUD exposure into the RBA meeting given our view about front-loaded RBA easing together with a sense that the China bounce has put a limit on short AUD positioning.

We do so through a 6w AUDJPY-USDJPY put switch, using the risk premia in USDJPY vols to subsidize AUDJPY downside (the tenor captures the next two RBA meetings). USDJPY has realized only 3.9% over the past month, the lowest point for gamma since 1977, compared to 2m implied of 5.7%. AUDJPY has realized 7.8% versus 2m implied of 8.8%.

Put spread switches historically perform better than put switches as they avoid buying the AUDJPY riskie that generally tends to underperform and they also cap the risk on the short USDJPY leg. But we see better value presently in a put switch, firstly because the event risk from the RBA could result in the AUD riskies for once performing, and secondly, because we see little near term risk of a major independent USD sell-off (the main risk to the trade, obviously).

Equally, the structure would benefit from any repeat of the low-liquidity, flash-crash JPY rally from January (a concern of some investors as Japan heads into its 10-day public holiday from April 27th - May 6th) as AUDJPY would once again likely outperform USDJPY. AUDJPY imploded by 8.1% on January 3rdcompared to a 4.9% slide in USDJPY.

Buy a 6w 76.75 AUDJPY put, sell a 6w 110 USDJPY put. Net premium 25bp, spot ref 78.65 and 111.65 for AUDJPY and USDJPY respectively.

Stay short AUDUSD from 0.7090 at the beginning of March. Marked at 0.77%. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly AUD spot index is inching towards -75 levels (which is bearish), while hourly USD spot index was at 19 (mildly bullish) while articulating (at 08:44 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  ECB Signals Steady Interest Rates as Fed Risks Loom Over Outlook

ECB Signals Steady Interest Rates as Fed Risks Loom Over Outlook  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons