Just a week ago, we at FxWirePro have well anticipated the potential slumps of AUDNZD and advised options strips as a hedging strategy accordingly when the underlying spot FX was at around 1.0610 levels, that contained 3 legs. Of which 2 lots of 2m at the money put options and 1 lot of at the money call option of similar expiration.

The current spot FX reference is at 1.0525 levels, thereby, one can easily make out how much positive cashflow the above-stated strategy would have fetched in. Hence, comparatively, puts have been more effective than calls so far.

Well, we are quite firm with our medium-term perspective, we could still foresee the potential for a further decline towards 1.0425 during this week and 1.0370 also, and given recent interest rate and commodity movements have slightly favored the NZD. Further out, it could target 1.08 also on the flip side which is close to fair value.

This’s the reason why we advised options strips that keep FX risks on the check regardless of the swings. On hedging grounds, AUDNZD major downtrend has been drifting in consolidation phase but now jerky in the medium run, this may cause price slumps upto 1.0370 levels.

We’ve seen the bearish impact on underlying AUDNZD movement in the major trend. Technically, the price behavior has been weaker with both leading as well as lagging indicators are bearish bias.

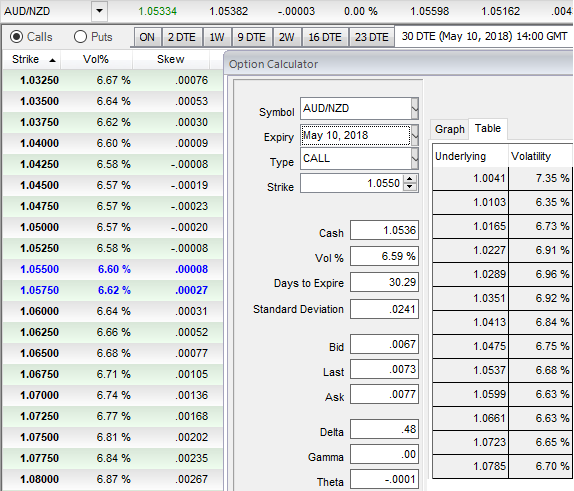

Contemplating all the fundamental driving forces and the ongoing technical trend of this pair, to participate in the puzzling swings, we advocate option strips strategy that contains 3 legs of vega longs (2 puts plus 1 call). As you could spot out IV skews are well balanced on either side (on both put/call), the option strips that likely to fetch desired yields regardless of the trend but more potential on southwards by arresting bearish risks.

As shown in the diagram, the execution goes this way: Initiate 2 lots of 1m longs in Vega put options, simultaneously, add 1 lot of Vega call options of the similar expiry, the strategy is executed at net debit.

Please be noted that the strategy likely to derive positive cashflows regardless of the underlying spot FX moves with more potential on the downside (please also be noted that the tenors shown in the diagram are just for demonstration purpose, use accurate tenors as per the requirements).

Currency Strength Index: FxWirePro's hourly AUD spot index is flashing at 71 levels (which is bullish), while hourly NZD spot index was at shy above 156 (highly bullish) while articulating (at 07:30 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close