Bearish AUD scenarios:

1) The unemployment rate moves back towards 5.75%, raising risks that the RBA responds to a weakening labour market;

2) The Fed responds to firm labour market outcomes and above-trend growth by delivering a faster pace of hikes than currently expected;

3) China data weaken materially; or

4) The risk markets retrace and vol rises as financial conditions tighten.

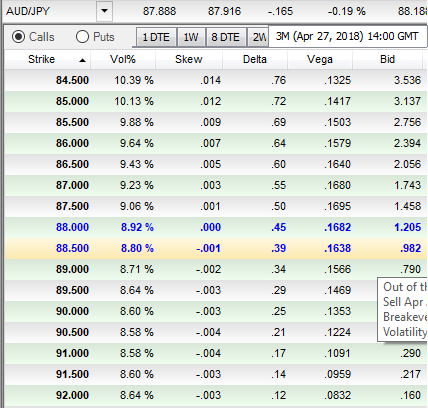

AUDJPY vols of 3m tenors are also at the decent side which is conducive for option holders, while skews have positively stretched on OTM put with attractive gammas, this Options Greek is the rate of change of the Delta with respect to the movement of the rate in the underlying market.

In the sensitivity table, Gamma shows how much the Delta will change if the underlying rate moves by 1%. Hence, we’ve chosen ITM striking put as we agree with JP Morgan’s projections.

Contemplating these aspects, on hedging grounds, risk-averse traders, capitalizing on deceptive rallies of the underlying spot FX, we advocate snapping rallies and buying a 3M 84.250 AUDJPY one-touch put.

Please be noted that the 3m ATM IVs of this pair is trading shy above at 9%.

Those who wish to reduce the cost of hedging; we advocate buying 4M sell 2M AUDJPY put spreads at 89/84.250 strikes in 1:0.753 notionals.

Currency Strength Index: FxWirePro's hourly AUD spot index is flashing at -24 levels (which is bearish), while hourly JPY spot index was at shy above -53 (bearish) while articulating (at 07:19 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?