Bearish scenarios:

1) The unemployment rate moves back towards 6%, forcing the RBA to respond more aggressively to weak inflation;

2) China data weaken materially.

Bullish scenarios:

1) China eases policy and commodities rebound;

2) The RBA adopts a more hawkish tone to its communications.

So far, RBA outlook seems to be on hold for some time which is anchoring short-maturity interest rates and should keep 3yr swap rates in a 1.8% to 2.3% range, as long as core inflation remains below 2%.

While JP Morgan’s projections of AUDJPY at 81 by Dec’2017, 79 by Q1’2018.

Hedging framework (AUDJPY):

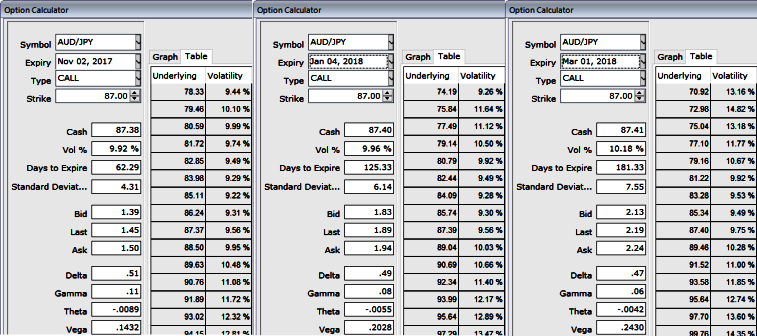

Please be noted that the IVs of ATM contracts are trading at 9.92%, 9.96% and 10.18% for 2m, 4m, and 6m tenors respectively.

On hedging grounds, risk-averse traders, capitalizing ongoing rallies of the underlying spot FX, we advocate shorting a 3M in premium-rebate notional and buying a 6M 84.250 AUDJPY one-touch put.

Those who wish to reduce the cost of hedging; we advocate buying 4M sell 2M AUDJPY OTM/ITM puts at 86/90.159 strike in 1:0.753 notionals.

Vols of 2m tenors are at the lower side which is conducive for option writers, hence, we’ve chosen ITM striking put as we agree with JP Morgan’s projections.

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch