EUR vol risk reversals remain low compared to the level of rates (refer above diagram). Also, in longer tails, the EUR volatility smile remains flat compared with the rates vs vol correlation seen since 2015 and over the past week (refer above diagram).

Despite the risk that the EURUSD correction goes further (it really hasn't gone very far yet), we're still very keen on EURJPY as a long-term long. As per the forecasts, a peak at 140 at the end of the year, and while that looks miles away it does remind that there is a lot to play for.

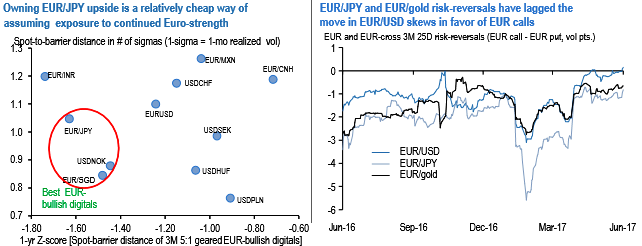

EURUSD risk-reversals flipped positive (bid for EUR calls) this week in sub-3M expiries in response to Euro strength, but there are still two laggards among Euro-crosses that are bid for EUR puts and have room to play catch-up if Euro strength continues: EURJPY (3M 25D r/r -0.8mid) and EUR/gold (3M 25D r/r -0.65 mid). Spot-vol correlation performed strongly positively this week and supports a narrowing of the EUR call discount: a 2.9% rally in EURJPY was accompanied by a 0.85 %pt. jump in 3M ATM, while a2.5% rally in EUR/gold led to a +0.4 vol uptick.

The obvious appeal of EUR-cross skews is that they earn smile decay while waiting for a re-pricing; they also avoid exposure to a Fed-driven bounce in the dollar, which isn’t looking much of a problem at the moment but has a low bar for resurfacing given the dollar’s substantial rates/FX disconnect and extended duration length in Treasuries.

According to JPM, the directional view of moderate gold weakness in H2 is more amenable to bullish Euro risk-reversal plays on crosses than the more constructive outlook on JPY, but even the latter may have room for near-term slippage amid widening Japan vs. rest of the world rate differentials and firmer equity market sentiment.

The steepness of the EURJPY risk-reversal curve renders back-end tenors better shorts, however, we prefer sticking to 2017 expiries (6M) since 2018 dates come with unpredictable Italian election risk. The EUR/gold risk-reversal curve is much flatter in comparison hence short tenors work fine. We enter short 6M 25D EURJPY risk-reversals (delta-hedged).

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation