Until just before the end of yesterday’s press conference ECB President Mario Draghi managed to ooze optimism and to successfully downplay the numerous risks for the euro zone growth and inflation outlook. As a result, the euro was initially able to appreciate moderately. If the journalists had not remained so stubborn on the subject of Italy this is probably how it would have ended.

However, with the last question about how the ECB would react if the EU budget row with Italy was to escalate further Draghi was finally cornered. Of course, he would have been able to carry on with his strategy and dispel this risk as an obstacle for the ECB’s normalisation plans.

The run-up to the crucial EU summit this week was marred by an unexpected impasse in Brexit talks as the government abruptly signalled that it could not support the draft withdrawal text that its officials and those of the EU had been working on.

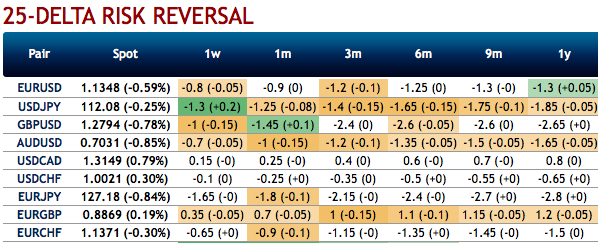

EUR- and EUR-bloc (USDNOK, USDSEK) risk-reversals are underperforming. Risk-reversals of euro crosses have been indicating increased bearish sentiments (refer above nutshell).

One could consider earning the risk premium on these surfaces for an Italian accident by selling riskies (shorting EUR puts, buying EUR calls) with an over-hedge on delta (i.e. short EUR forwards) to protect against a left tail event.

The advantage is that both the risk-reversal short and the delta-hedge are positive carry in nature, and could be complementary to existing short EUR directional option structures in macro portfolios. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards -27 levels (which is mildly bearish), hourly USD spot index was at 52 (bullish) while articulating (at 13:35 GMT). For more details on the index, please refer below weblink:

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts