In the recent past, the trade protectionism theme shot back into focus as a potential major left tail risk for markets. Implied and realized volatility has rebounded from low levels driven by general risk-off moves in the market. FX vols climbed more than 1.5pts on VXY-EM basket and ~1vol pts on VXY-G10 within a week. The sharp vol rally eliminated the extreme cheapness of the EM basket, lifting the VXY-EM off the July multi-year low.

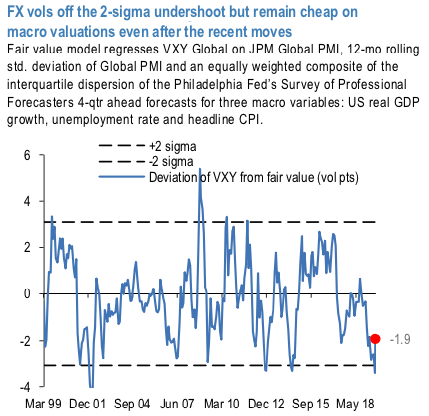

Nevertheless, VXY-G10 is only back to the year start levels and on our workhorse cyclical framework, which takes into account the trajectory and surprises in Global PMIs and ex-ante forecast uncertainty surrounding key macroeconomic variables, FX vols are now off the 2- sigma undershoot but remain ~2pts cheap on macro valuations even after the recent move (refer 1stchart).

Spot gyrations generated strong gamma returns especially in Asia EM and x-JPY (refer 2nd chart). How widespread and how impactful the trade escalation has been the best seen from the 1-week returns which are >90 percentile of YTD weekly returns for 26 out of 30 currencies in the Exhibit. We do not see a quick resolve and remain defensive though the current indications are that PBoC may want to bring back calm into FX.

The news of the additional US tariffs also resulted in EM currencies/equities crumbling overnight. Apart from the Chinese readings, Asian manufacturing PMIs came in mixed to weaker. Short-end EMFX vols are ‘waking up’ again, with Chinese equities slumping in early trade on Friday.

Overall, expect USD-Asia upside to persist, especially with regional currencies now lacking the buffer of net portfolio inflows. Asian (IRS) yields meanwhile may be expected to take the cue from the global core curves and explore the downside once again, flushing out any ambiguity witnessed immediately after the FOMC.Courtesy: OCBC & JPM

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays