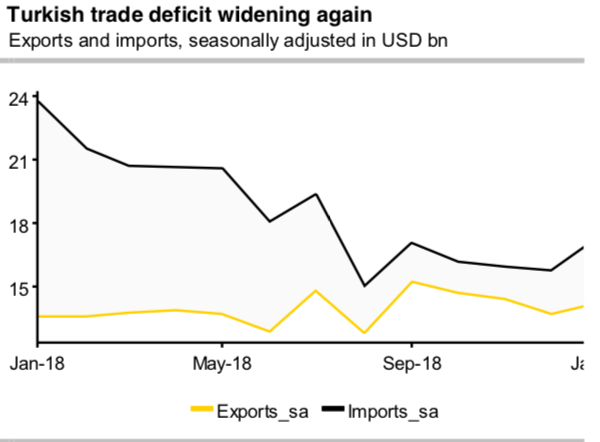

Turkey’s trade data for January confirmed that the deficit which had narrowed considerably following the lira crisis last year has begun to widen out again. It is early days still, and this could turn out to be noise, but the development deserves attention as imports are beginning to outpace exports once more and the trade deficit has begun to re-widen (refer above chart).

It has more than doubled from its low of October 2018 and we should watch out for how it responds as policymakers try to boost the economy using monetary easing.

The benchmark rate is not being cut and we do not expect CBT to cut rates next week either but broader conditions are being eased via RRR cuts and easing of lending norms. If these do not work, then fiscal stimulus is likely to be increased. The point is that the government is unlikely to simply accept low GDP growth. As it provides more stimulus, the economic re-balancing which occurred last year will partly reverse.

We see the risk that the market has been over-optimistic about how many long-term structural problems in Turkey were solved by last year’s crisis. And disappointment in this regard, going forward, will have obvious lira implications.

Trade tips (USDTRY): At spot reference: 5.3590 levels, contemplating above macroeconomic fundamentals, we advocate initiating longs in 3M USDTRY at the money -0.49 delta put, and go long in at the money +0.51 delta call of similar expiry and simultaneously, short 2w (1%) out of the money puts. Thereby, we favor slightly on upside risks and short leg likely to reduce the cost of the strategy.

The rationale for the trading: Please observe that the above technical chart is also clearly indicating the further upside risks.

It seems that hedgers of TRY are also in line with the above fundamental factors. As you could observe the above nutshell, IV skews of USDTRY have extended on either side that indicates both the upside and downside risks as the hedgers’ interests for both OTM calls and OTM puts.

IVs of this underlying pair is on the higher side, trending highest among the G20 FX space. Courtesy: Sentrix & Commerzbank

Currency Strength Index: FxWirePro's hourly USD spot index is inching towards -51 levels (which is bearish) while articulating (at 11:38 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data