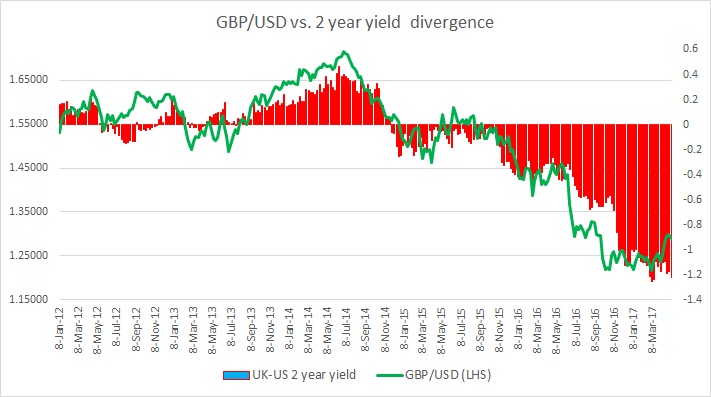

The chart above shows, how the relationship between GBP/USD and 2-year yield divergence has unfolded since 2012.

- The cozy relationship between the yield spread and the exchange rate, in this case, is quite visible. Back in 2013/14, it was widely expected that UK’s economic prowess and the disappointment that the Bank of England (BoE) governor Mark Carney wasn’t as dovish as expected, fuelled the increase in yield divergence in favor of the United Kingdom and strengthening of the pound against the dollar.

- But as economic growth slowed and the BoE expressed a greater desire for a cautious approach, yield spread (UK-US) declined and exchange rate softened.

- In 2016, the yield spread has declined sharply into the negative, especially since the referendum date was announced. The actual decline began in September 2015 as the market was speculating that the referendum will be held in 2016, instead of 2017. The yield spread declined from -0.1 percent in September 2015 to -0.4 percent by early 2016.

- A week before the referendum the yield spread between 2-year gilt and the 2-year treasury was trading at -0.36 percent and after it, the decline was very sharp. By October, It declined to -0.65 percent. And the pound declined from 1.36 against the dollar to 1.25 against the dollar.

- Since the US election that was won by Donald Trump, the yield spread deteriorated sharply to -1 percent. However, this didn’t prompt renewed weakness in the pound as it was moving ahead of the spread already.

- In our last review in February this year, we noted that the yield spread has widened further by 12 basis points to -1.12 percent but that didn’t soften the pound to new low against the dollar as investors remained focused on the high levels of uncertainties surrounding Brexit and the recent spike in the inflation in the UK. The pound was then trading at 1.244 against the dollar.

Since our last review, it is quite evident that the pound recovered as the yield spread narrowed in favor of the UK from 1.26 percent in early March to 1.09 percent by mid-April. What is more important to note is the recent divergence, while the spread has widened the pound hasn’t followed suit. Currently, the spread is at 122 basis points, while the pound is trading at 1.288 against the dollar.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022