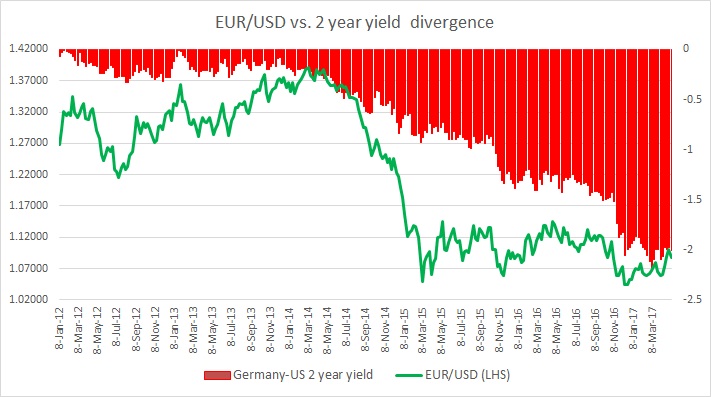

The chart above shows, how the relationship between EUR/USD and 2 year yield divergence has unfolded since 2012. It is evident that these short rates have been a key influencing factor for the pair as policy divergence became evident since 2013.

Past divergence and move in the exchange rate:

- As the speculations from extraordinary monetary stimulus became frenzy since the beginning of 2014, yield divergence between German 2 year bond (considered as European benchmark) and the US 2 year note went from -0.18 percent at the beginning of 2014 to -0.78 percent by the end of the year and EUR/USD declined from 1.367 to 1.2 by year end.

- We saw further drop in the EUR/USD exchange rate in 2015 as ECB introduced monetary stimulus but the yield failed to follow that fast, it only started declining as the expectations for further stimulus grew and by end of December, declined more than 50 basis points compared to the first quarter of 2015.

- European Central Bank (ECB), however, disappointed in December 2015 and only to deliver in March, 2016. Since December, Germany-US yield divergence has moved in a range lacking clear direction as the Fed became more cautious than expected. So had the EUR/USD.

- From summer last year, the yield spread has started declining again and after Donald Trump won the US presidency, the spread has widened sharply. In August, the spread was at 1.35 percent and it deteriorated to -1.43 percent just before the US election and in December it reached -1.87 percent. Similarly, the euro has declined from 1.11 against the dollar, prior to the election to 1.065.

- In our last review in February, we discussed that the yield spread has widened further by almost 20 basis points. However, the exchange rate hasn’t followed through, and we pointed to the divergence building up.

Since our last evaluation in February, we can note that while geo-political factors are playing key role influencing EUR/USD, the yield spread is also playing its part. The recent spike in the EUR/USD exchange rate coincided not only with the French election outcome but a narrowing of the spread too. But recently, the spread widened and the euro declined against the dollar. Currently the spread stands at 200 basis points, while euro is hovering around 1.087 against the dollar.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed