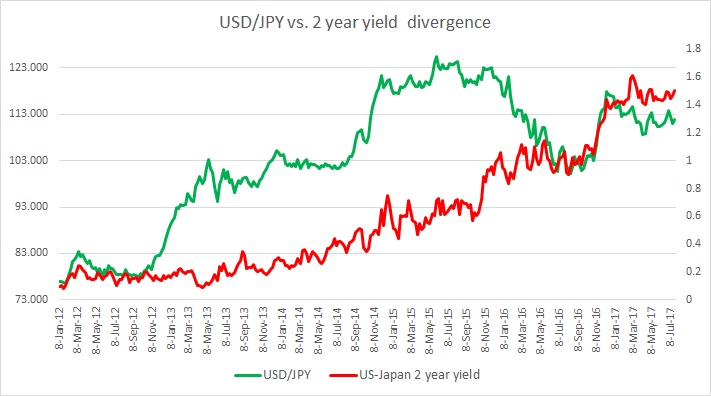

This one pair has been at odds with yield divergence throughout early 2016 as the yen benefited from risk aversion and due to market participants’ doubts on BoJ’s abilities to ease policies further.

- It had shown excellent response to the yield divergence in the past, especially after Bank of Japan (BoJ) announced its quantitative easing program back in 2012. The close relationship lasted until summer of 2015. US-Japan 2 year yield spread rose from 0.13 percent in 2012 to 0.72 percent by May 2015 and hovered there till October and the exchange rate reached from 76 to 126 in that same period.

- However, trouble started surfacing after summer. We guess it was triggered by surprise devaluation of the yuan by the Chinese central bank, People’s Bank of China (PBoC).

- The yield spread kept rising in favor of the dollar. The yield spread rose more than 30 basis point since summer, but, the yen has strengthened from 126 to as low as 98.

- After Donald Trump, the Republican candidate secured a victory in last year’s US election the exchange rate started to respond to the yield difference once more. After Mr. Trump’s victory, the yield gap jumped suddenly by more than 25 basis points and the yen has weakened to 114 per dollar from as high as 101 per dollar.

Since our last evaluation in May, both the spread and the exchanged rate have changed by a small amount. The spread widened by 7 basis points in favor of the dollar and yen weakened by 60 basis points against the dollar. The spread is currently at 151 basis points (US-Japan) and the yen is at 111.8 per dollar.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions