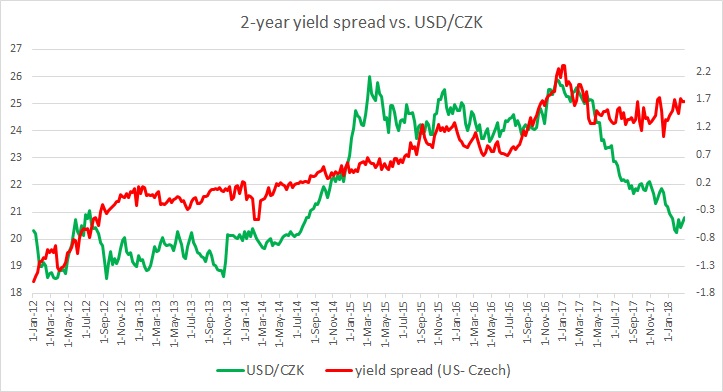

The chart above shows, how the relationship between USD/CZK and 2-year yield spread has unfolded since 2012.

- It can be seen even with a naked eye, that the pair and the yield spread between 2-year treasury and 2-year Czech government bond have enjoyed a fairly close relationship.

- The Czech National Bank (CNB) began reducing interest rates in the aftermath of the ‘Great Recession’ of 2008/09. The interest rates declined steadily from 375 basis points in 2008 to just 75 basis points in 2010.

- The interest rates were reduced again in the aftermath of Eurozone debt crisis. In 2012, CNB reduced rates from 75 basis points to just 0.05 basis points and it remained at the level until recently.

- In addition to that, in 2013, CNB pegged Czech Koruna with the Euro at 27 per euro.

- It can be seen from the chart as CNB started reducing rates again in 2012 and maintained dovish tone, while the US Federal Reserve indicated that it is going to wind up its asset purchases, the 2-year yield spread widened in favor of the dollar and the exchange rate declined from 19 per dollar to 26 per dollar.

- However, there has been a change in tone in CNB communications since last year and this year CNB has not only removed its euro peg but in August increased interest rates from the first time since 2008. The rate was increased by 20 basis points to 25 basis points.

- In our in August, we noted that the exchange rate and the spread have responded accordingly. Koruna has strengthened from 26 per dollar to 22 per dollar, while yield spread declined from 232 basis points in January to 134 basis points. We suggested that the expectations of a change in CNB policies as well as a rebound in Eurozone economies to be playing parts. However, we also noted that the exchange rate has moved much faster than the spread, which is unlikely to be sustained in the medium term.

- In our last review in early October, we noted that the spread has narrowed by around 7 basis points in favor of the Czech Koruna, while the Koruna has declined by 13 pips, thus reducing the divergence to some extent.

- In our late October review, we noted that the spread hasn’t changed much since our last review and was at 127 bps and Koruna has also remained flat, which was then trading at 22.05 per dollar.

- In our last review in December, we noted that while CNB has increased interest rate by 25 bps to 50 bps, the spread has widened by 12 bps to 139 bps in favor of the USD and the exchange rate declined from 22.05 per USD to 21.74 per USD, thus increasing the divergence.

Since that review, CNB has raised the rates again in January, making it thrice since July. The spread, however, has further widened to 165 bps in favor of the USD but the Czech Koruna strengthened from 21.74 per USD to 20.8 per USD.

Such divergence is unlikely to sustain in the medium to long-term.

With central banks changing their monetary policy outlooks, we highly recommend regular following of the yield spread.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022