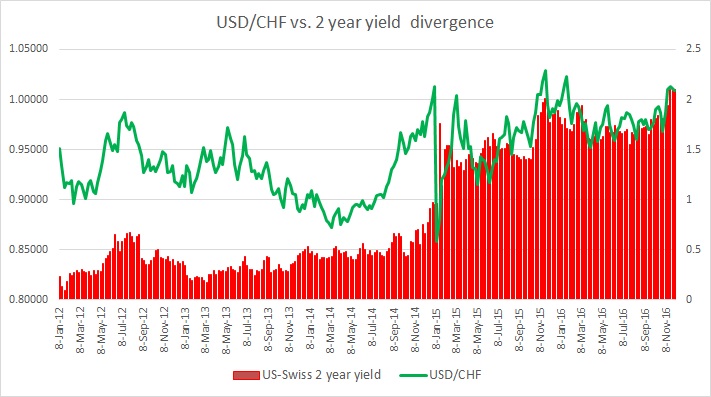

In recent days, Swiss franc’s correlation with the 2-year yield spread (US-Swiss 2 year) has risen to 78 percent and time on time again it shows relatively high positive correlation, as high as 90 percent at times. Just before and after the Brexit referendum in the UK, the 20-day rolling correlation was averaging above 60. Hence, it is vital to keep a watch on the Swiss yields.

Just after the Swiss floor shock in January 2015 when the Swiss National Bank (SNB) removed a floor in EUR/CHF at 1.20 this relation went to negative and stayed there till October with occasional bounces to positive territory. It hasn’t gone much to the negative since.

Unlike the euro or the pound, Swiss franc is considered a safe haven currency; hence the yield relation sometimes gets overlooked.

However, Swiss yields are a must watch as they are the lowest for any government bonds in the world and any shift in that will mark a major turnaround in trend. The above chart explains how the relation between the spread and exchange rate has unfolded since 2012. The recent weakness in the franc can also be attributed to the sudden sharp rise in the yield difference after Republican candidate Donald Trump won the US Presidency. As of now, the yield spread is at 2.01 percent and the franc is currently trading at 1.009 per dollar.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength