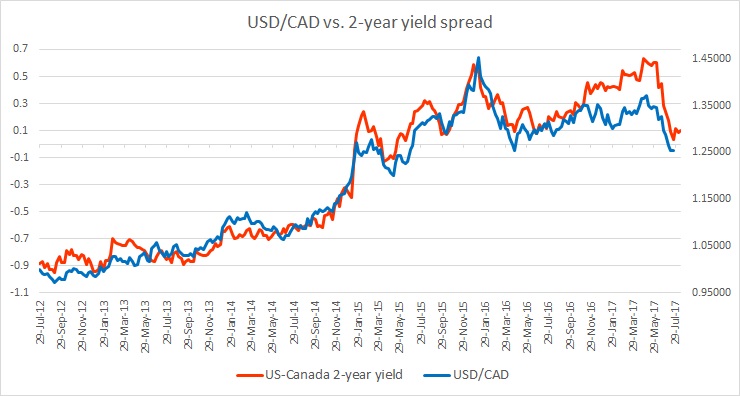

The chart above shows, how the relationship between USD/CAD and 2-year yield divergence has unfolded since 2012.

- The close relations between the short-term yield spread and the exchange rate is quite visible and the relation, in this case, is closest among all commodity pairs.

- Reserve Bank of Canada (BoC) reduced rates from 300 basis points to just 25 basis points after the financial crisis of 2008/09. It somewhat increased interest rates due to a recovery in oil prices and higher inflows of money from other western economies. It raised rates by 75 basis points to 1 percent in 2010. It started reducing rates again beginning January 2015. The rates steadily declined from 1 percent to 0.5 percent by July 2015, when it signaled a halt.

- It can be seen from the chart that the Canadian dollar declined from a parity against the dollar in 2012 to 1.18 per dollar by the end of 2014. The yield spread during the period rose from -88 basis points to -37 basis points in favor of the US dollar. As the spread continues to rise and reached 13 basis points, the Canadian dollar declined to 1.25 per dollar.

- The spread reached a peak around 56 basis points in January 2016 and the Canadian dollar declined to 1.45 per dollar. By April that year, the spread narrowed to 10 basis points and the Canadian dollar declined rose to 1.25 per dollar.

- While April this year, the spread widened again to a new peak of 63 basis points in favor of the USD, the Canadian dollar declined only to 1.37 per dollar.

- After BoC signaled a possible rate hike in June, the spread narrowed from 60 basis points to 7 basis points as of today and the loonie has strengthened from 1.35 per dollar to 1.255 per dollar.

Since our last review in July, the yield spread has narrowed by almost 7 basis points in favor of the US dollar and the loonie has declined 180 basis points against the dollar.

We highly recommend steady monitoring of the spread as it is showing high levels of correlation with the exchange rate.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest