Over the next few articles, in our fundamental evaluation series, we would check the valuations of the S&P 500 under various parameters, especially since by many measures S&P 500 is looking quite expensive. The U.S. benchmark is in its eighth year of consecutive bull run.

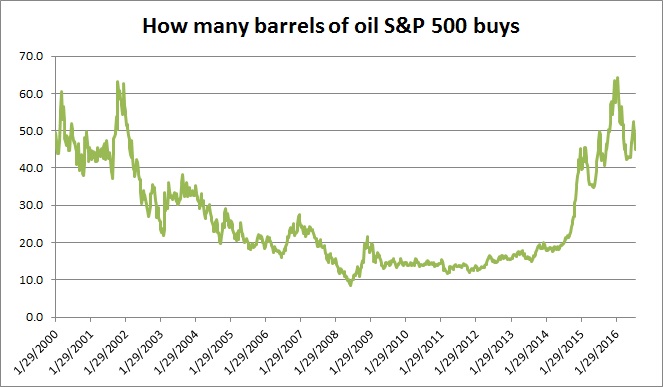

In this one, we are evaluating the value of S&P 500 in terms of WTI oil. The chart shows the valuation is quite high, though recently it has declined from the peak. Historically one unit of S&P 500 has bought 23.1 barrels of WTI crude. Currently, it buys 48.6 barrels. Though it is down from the peak 63.5 seen in January this year, it is still 111 percent higher compared to the average. If the theory of mean reversion holds, we are likely to see the valuation drop either via a decline in the index or rise in the crude oil price.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX