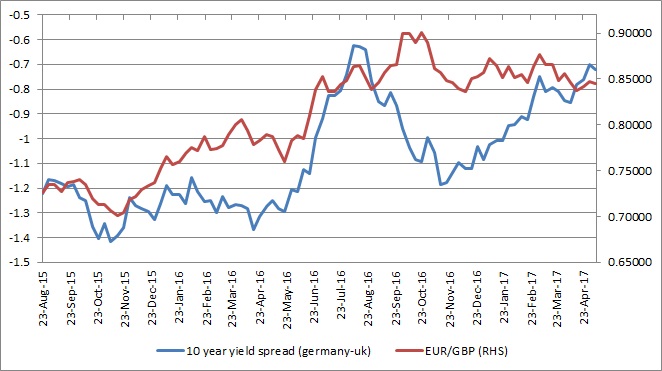

This chart shows the performance of EUR/GBP exchange rate in contrast to the performance of long-term yield divergence between 10-year German bund and 10-year UK gilt.

- During our evaluation period beginning August 2015, we can see that long-term yield difference between the German bund and UK gilts are somewhat going hand in hand with the EUR/GBP exchange rate. While the yield spread topped in late August last year, the EUR/GBP exchange rate moved higher to peak in early October around 0.92 area.

- A very interesting point to note would be the divergence between the long-term rates and EUR/GBP exchange rate. Since the British last year, we can visually see that while the spread widened from 62 basis points to 119 basis points in favor of the UK, the pound initially weakened against the euro. As the spread narrowed since November last year, from 119 basis points to 70 basis points now, the exchange rate has been in a consolidation phase.

- The correlation between the spread and the exchange rate declined from a positive 93 percent in last August to negative 26 percent as of now.

It is clear that other fundamentals are exerting much more impact on the pair than simple rate divergence, which is not surprising given the impact of Brexit on the future of the UK.

What might affect the yield spread significantly going forward?

- Upcoming election in the UK

- The outlook from both the Bank of England and the European Central Bank.

- Inflationary outlook in the United Kingdom due to a weaker pound.

- Brexit negotiations

Currently, we have forecasted for the exchange rate to decline to as low as 0.8 in the short term. It is trading at 0.845

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX