Business conditions in France improved at the fastest pace since May 2011, following sharp increases in output and new orders in December. The rate inflation of manufacturers’ costs was meanwhile the strongest for five-and-a-half years, which in turn led to a second straight monthly rise in selling prices.

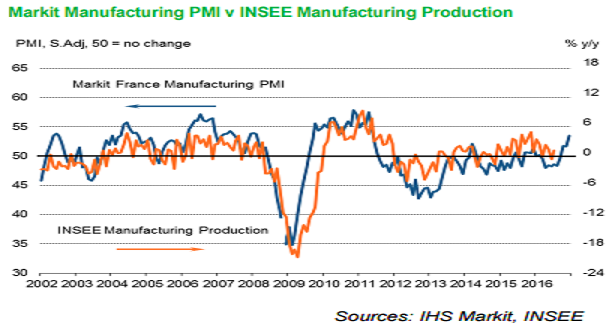

The headline Markit France Manufacturing Purchasing Managers’ Index (PMI) posted 53.5 in December to signal a further improvement in the overall health of the French manufacturing sector. The index figure was up from November’s reading of 51.7 and at a 67-month high. Any figure greater than 50.0 indicates overall improvement of the sector, while any reading below 50.0 indicates overall deterioration.

In line with the trend for output, the amount of new business placed with French manufacturers also increased in December. Likewise, the rate of expansion was the sharpest in 67 months. Growth was broad-based across both domestic and foreign clients, with December seeing a third successive rise in export orders.

Faced with higher production targets, firms looked to enhance their operating capacity in December, which in turn led to the fastest rate of job creation since June 2011. In spite of this, the amount of unfinished work at French manufacturing companies continued to accumulate.

"These are positive signs for France as the country contends with high levels of unemployment," said Alex Gill, Economist, IHS, Markit.

Meanwhile, the EUR/USD traded at 1.04, down -0.34 percent, while at 9:00GMT, the FxWirePro's Hourly Yen Strength Index remained neutral at -31.07 (a reading above +75 indicates a bullish trend, while that below -75 a bearish trend). For more details, visit http://www.fxwirepro.com/currencyindex

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality