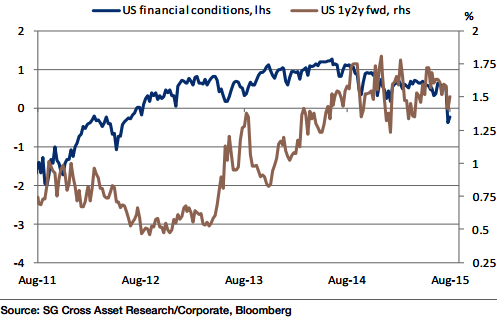

Comments by Fed members suggest the FOMC could still raise interest rates on 17 September. This is the base case scenario due to the optimism for rising US wage growth. It is cognizant of the greater uncertainty due to financial market turmoil and worries of negative spillovers from China/Asia.

Futures markets have cut the probability of a 25bp increase to less than 35%. In other words, a rate increase would come as a surprise, but how will markets respond? Buy USD or sell risk?

"The FOMC statement will be at least as important to assess whether or not the USD rally is over, and whether EM currencies can cheapen more. Q2 GDP was revised up from 2.3% to 3.7%. US growth will average 2.5% this year and inflation will average 0.3%", says Societe Generale.

Fed rate hike conditional for renewed USD strength

Friday, September 4, 2015 3:37 AM UTC

Editor's Picks

- Market Data

Most Popular

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness