FOMC minutes from the December meeting suggested that the Fed policymakers thought the economy could grow more quickly because of fiscal stimulus under the Trump administration. Nevertheless, members expressed concerns about the 'uncertain' economic outlook until more information about Trump's actual economic policy is available. 'Almost all' FOMC members think there are upside risks to their growth forecasts.

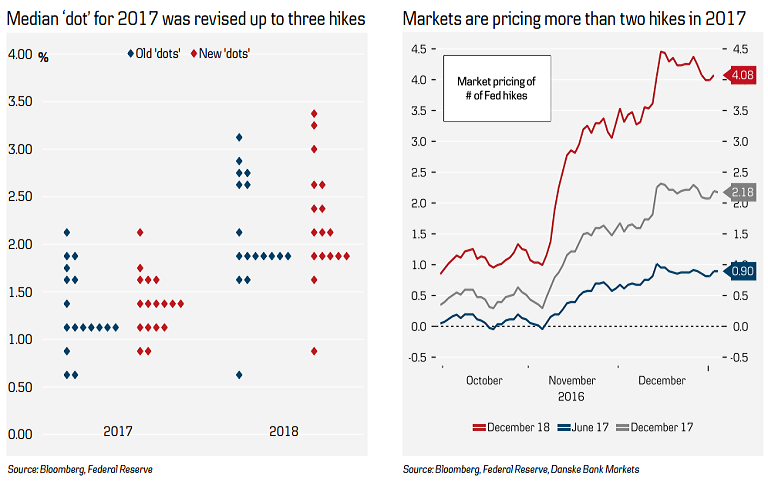

The central bank's policy-setting committee unanimously raised interest rates last month by a quarter of a point and policymakers signaled a faster pace of rate increases in 2017 than previously expected. That was seen as the Fed's first reaction to Trump's victory in the Nov. 8 election. But the minutes showed policymakers might signal an even more aggressive path of rate increases if inflationary pressures rose.

Policymakers were clear that the outlook for those policies remained uncertain, but they could, if implemented, stoke higher inflation which would lead the central bank to raise borrowing costs more aggressively. The Fed is likely to stick to its current reinvestment policy in 2017. However, several participants noted circumstances that might warrant changes to the path for the federal funds rate could also have implications for the reinvestment of proceeds.

Fed projections last month pointed to a labor market heating up to just a little stronger than its longer-run normal level. The minutes, however, saw risk of a sizable undershooting of the longer-run normal unemployment rate had increased somewhat and that the Committee might need to raise the federal funds rate more quickly.

"Fed will hike twice this year (June and December) but risk is skewed towards three hikes. Fed has turned more dovish this year due to shifting voting rights. That said, we believe the Fed is likely to increase the hiking pace in 2018 (late 2017 at the earliest), as we think Trump's fiscal policy is likely to have the biggest growth impact in 2018 due to policy lags," said Danske Bank Markets in a report.

U.S. short-term interest rate futures rose slightly after the release of the minutes but not enough to suggest altered expectations for the central bank's rate hike path this year. U.S. stock prices were largely unchanged. EUR/USD extended upside to hit 1.0575, USD/JPY slips to 3-week lows of 115.58.

FxWirePro Currency Strength Index: FxWirePro's Hourly USD Spot Index was at -20.7827 (Neutral) and Hourly EUR Spot Index was at -37.9328 (Neutral) at 1145 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality