Heading into the July meeting, there were two key questions on investors' minds: (1) when would the first hike occur; and (2) how quickly would normalisation proceed thereafter. While the answer to the second question remains out of view, that for the former is (a little) clearer following the July meeting.

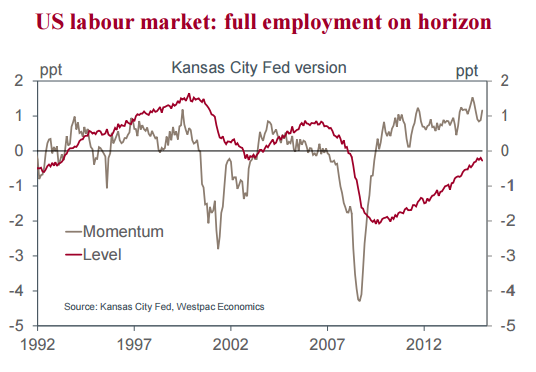

The FOMC's optimistic outlook for the US economy depends on the consumer. Consequently, while much improvement had been seen in the labour market and in household wealth, the Committee wanted to see "further improvement in the labor market" before they were willing to begin raising rates. From today's statement, it is clear that this requirement has been partially fulfilled, with "some further improvement in the labor market" now required.

Elsewhere in the July meeting statement, there was further evidence of members' confidence in continued progress towards full employment. "The labor market continued to improve, with solid job gains and declining unemployment" was an upgrade from June's "The pace of job gains picked up while the unemployment rate remained steady". Also, on labour market slack, the tone was more definite: "a range of labor market indicators suggests that underutilization of labor resources has diminished since early this year", versus "a range of labor market indicators suggests that underutilization of labor resources diminished somewhat" in June.

For now, inflation continues "to run below the Committee's longerrun objective" (2% PCE inflation in the medium term). However, continued gains for the labour market will provide belief that, as the remaining slack erodes, wages will firm, stoking inflation pressures. It is also fair to say that members of the Committee continue to believe much of the current disinflation will prove transitory, with the effect of the oil price decline and stronger US dollar to wane.

The final upgrade on the June statement was a more positive perspective on housing: "the housing sector has shown additional improvement. Gains for existing home sales and new construction mean the housing market is no longer a major impediment to policy; instead, 'inadequacies' still evident (like the historically-soft level of new home sales and mortgage activity) are now seen not as risks but as opportunities for growth as headwinds abate.

For the FOMC and Fed officials, it is not the level of growth relative to that achieved historically which matters; instead, it is the potential rate of growth now achievable and the degree of residual slack apparent. Their discussion of the labour market; 2016/17 FOMC growth expectations above 'longer-run' estimates; and the aptly-timed (albeit accidental) release of forecasts from Fed staff showing the output gap closing and turning positive through 2016/17 all signal the zero bound for rates is no longer appropriate, green-lighting a September first hike.

While the FOMC is soon to act (and will likely act again with only a brief delay), participants will do well not to automatically extrapolate this pace through 2016/17. That the growth forecasts of the FOMC and Fed staff are both well below that achieved pre-GFC signals the 'new norm' for rates will also be much lower. A slow and measured pace of hikes expected in 2016/17 as the data allows.

FOMC expectations, near and far

Wednesday, July 29, 2015 11:33 PM UTC

Editor's Picks

- Market Data

Most Popular