The event the world has been awaiting, preparing and speculating for is finally approaching - meeting by US Federal Reserve, in which US interest rates will finally rise from their zero bound. Market is now pricing 72% probability of a rate hike by FED this week. Meeting scheduled for December 15th-16th.

In this, FED liftoff series, we will be discussing over the impact, implications and various possibilities of a first rate hike from FED in about a decade. Last time FED hiked rates was back in 2006.

In previous articles we discussed why rate hike from FED is still crucial, despite it being well priced in, beginning of a mega unwinding of monetary stimulus and our take on US rates via term premia.

In this piece, we address impact on equities.

How will the hike be for equities?

Investors and analysts' community is quite well-divided over this.

Legendary investors Warren Buffet, months back has warned against equity valuations, saying they may not look cheap after interest rates go up.

While this week, Barron's outlook forecasted that equities might go up by 10% in 2016, arguing, FED hike indicates economy is healthy and growing and a growing economy could increase earnings for the companies. Moreover, outlook brightens for financial institutions' stocks as their portfolio return improves with hike. Banking and insurance share price are quite cheaper, compared to other sectors. Since historically banks have done well in a time of rate hike, they could be good portfolio hedge for investors.

Other just shrug off the hike, suggesting a mere 25 basis points, doesn't mean much.

Lessons from history -

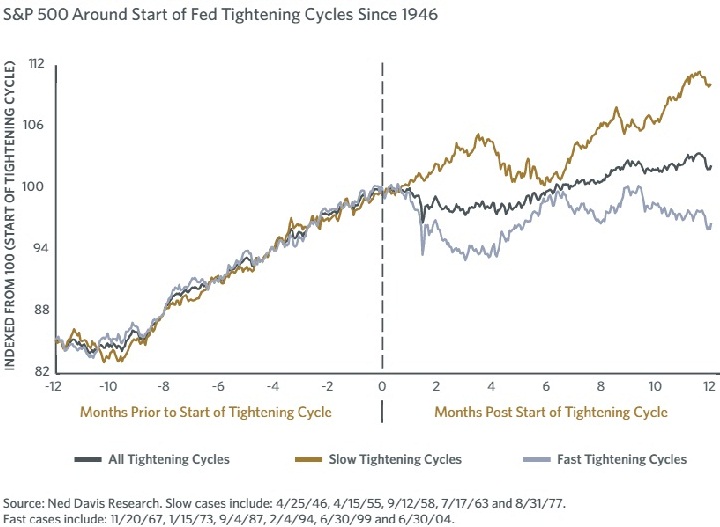

Analysts at Bank of New York Mellon have done a fabulous job in this regard. With data from Ned Davis Research, they have chalked out the historical performance of US S&P500 performance, prior and post hike in 12 months' time horizon. The figure attached, is probably worth more than thousands words.

According to history, FED hike doesn't signal crash of stock market, on the contrary there has been times, when it did well despite hike.

For the past 70 years, US stock market has moved up by 3%, on an average, after first rate hike from US Federal Reserve.

Market has under-performed by 3%, if the hike has been fast paced, whereas gradualist approach has seen equities return 11% on an average.

Ms. Yellen is right -

FED chair Janet Yellen has been pointing out for quite a long time, not to ponder too much on the first rate hike as the path matters.

History is also saying the same thing, pace of hike would be more important for equities over next 12 months. If FED do stick to its words of gradual approach, stocks are likely to do just fine.

Keep FED commentaries on check, for further guidance. Another rate hike in 2016 could be considered fine, whereas more than two could be death nail for the market.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal