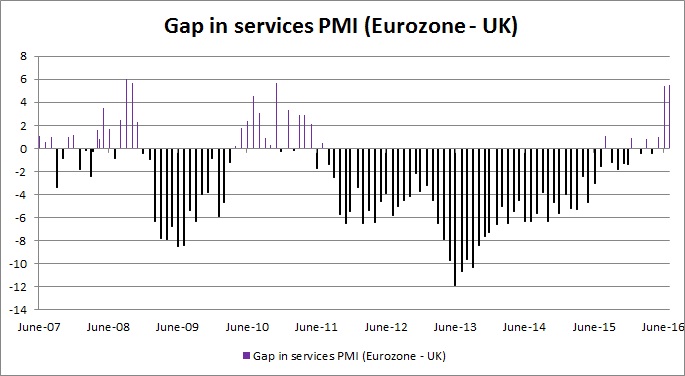

Latest data from the Markit economics show that after the UK referendum on the membership of the European Union, services across the Eurozone gained ground while services activity slowed down markedly in the United Kingdom. The gap between the PMI’s (Eurozone vs. UK) has reached multi-year high. So far, not much hard evidence has been out that shows that the UK referendum is leading to a marked slowdown except for the sentiment data and the PMIs which are showing marked deterioration.

If this trend of weakness in the UK and stability in the Eurozone persists, it will add pressure on the UK government who has vowed to exit from the Union. While British Prime Minister Theresa May’s new government has moved fast to attain the political uncertainties, it hasn’t moved fast enough to dissuade economic fear. Both the UK treasury and the Bank of England (BoE) has been waiting so far for hard evidence before taking any actions.

The chart attached not just focus on the current divergence, it sheds light on a trend, which has been quite prominent for years now. After reaching the peak in the summer of 2013, the gap between the UK services activity and that of Eurozone’s has been reducing since. Eurozone’s recovery, despite being slow seems to be continuing steadily.

If the economic divergence continues, it would threaten the pound against the euro. The euro is currently trading at 0.837 against the pound.

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns