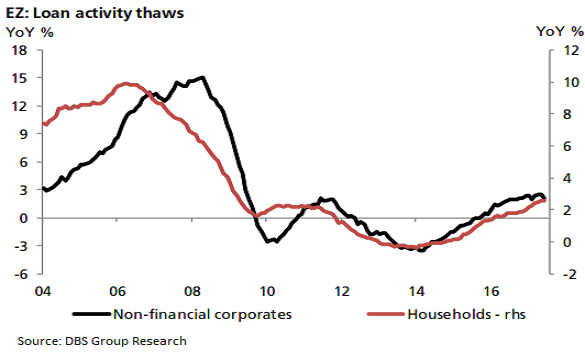

The European Central Bank’s accommodative policy stance continues to thaw credit growth. In Jun17, credit growth to households rose to 2.6 percent y/y, stable from month before but higher than last year’s average 1.7 percent. There are some concerns over a modest slowdown in lending to corporates to 2.1 percent from May’s 2.5 percent, but this is still an improvement from last year.

Broader improvement in other confidence and real data suggests this pullback might be a blip rather than a trend. The ECB’s bank lending survey for Q2 had also signaled that credit standards for loans to enterprises eased slightly, whilst those towards households was largely unchanged. Better access to banks’ and markets-based funding is likely to support the improving consumption and investment trends, entrenching recovery expectations.

Amidst these encouraging signs, the policymakers will be keen to see the extent to which the revival in investment growth improves pricing power and wage pressures. This is necessary to ensure a virtuous cycle for inflation and inflationary expectations.

With inflation still influenced by supply drivers rather than demand-led, we reckon that the markets will not be able to ignore the ECB’s guidance that it will remain patient during the QE withdrawal process. The ECB holds an estimated EUR1.6 trillion worth government debt, which is expected to be unwound, gradually, 2018 onwards.

An ECB official Ewald Nowotny, cited the US Fed’s example, saying that the ECB need not set a time table for unwinding QE purchases. In the immediate term, attention will be on July inflation numbers due on Monday.

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal