Euro Zone sentiment report showed confidence tilted despite additional stimulus from European Central Bank. Moreover the data were collected before recent terror attack on Brussels.

- Economic slowdown and fear among business leaders that monetary policy reaching its limit likely to be major driver behind ebbing optimism.

- However concerns over immediate hard landing in China is less of a concern now.

- The potential British exit from the Union, id what some business leaders likely to be worrying about. Lot of investment projects are on hold.

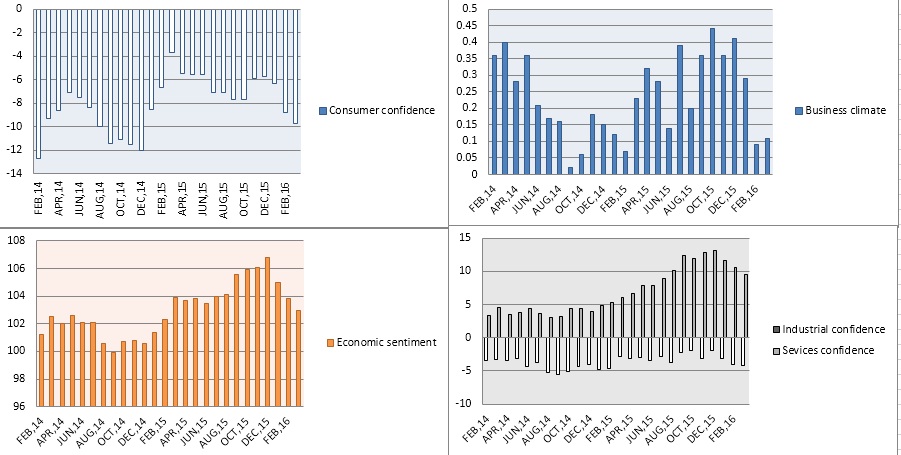

Today’s economic survey showed that sentiment across Euro zone dropped.

- Euro zone business climate is the only indicator that improved but marginally to 0.11. Still around levels last seen back in February last year.

- Industrial confidence dropped to -4.2 lowest since February, 2015. Economic sentiment soured to 103 worst reading since February, 2015.

- Services sentiment dropped drastically to 9.6, lowest reading since July, 2015.

- Consumer confidence dropped to -9.7, worst reading since December, 2014.

All in all trend suggests, that Euro Zone confidence picked in December last year and haven’t really recovered after ECB disappointment and Market turmoil at start of the year.

Euro broadly ignored the release and gaining over weaker Dollar, currently trading at 1.131 against Dollar.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Trump Extends AGOA Trade Program for Africa Through 2026, Supporting Jobs and U.S.-Africa Trade

Trump Extends AGOA Trade Program for Africa Through 2026, Supporting Jobs and U.S.-Africa Trade  India Services Sector Rebounds in January as New Business Gains Momentum: HSBC PMI Shows Growth

India Services Sector Rebounds in January as New Business Gains Momentum: HSBC PMI Shows Growth  Asian Currencies Strengthen as Indian Rupee and Australian Dollar Rally

Asian Currencies Strengthen as Indian Rupee and Australian Dollar Rally  Dollar Steady as Fed Nomination and Japanese Election Shape Currency Markets

Dollar Steady as Fed Nomination and Japanese Election Shape Currency Markets  US-India Trade Bombshell: Tariffs Slashed to 18% — Rupee Soars, Sensex Explodes

US-India Trade Bombshell: Tariffs Slashed to 18% — Rupee Soars, Sensex Explodes  U.S. Stock Futures Rise as Investors Eye Big Tech Earnings and AI Momentum

U.S. Stock Futures Rise as Investors Eye Big Tech Earnings and AI Momentum  U.S. Stock Futures Edge Lower as Tech and AI Stocks Drag Wall Street Ahead of Key Earnings

U.S. Stock Futures Edge Lower as Tech and AI Stocks Drag Wall Street Ahead of Key Earnings  Australian Scandium Project Backed by Richard Friedland Poised to Support U.S. Critical Minerals Stockpile

Australian Scandium Project Backed by Richard Friedland Poised to Support U.S. Critical Minerals Stockpile  Oil Prices Steady as Markets Weigh U.S.-Iran Talks, Dollar Strength Caps Gains

Oil Prices Steady as Markets Weigh U.S.-Iran Talks, Dollar Strength Caps Gains