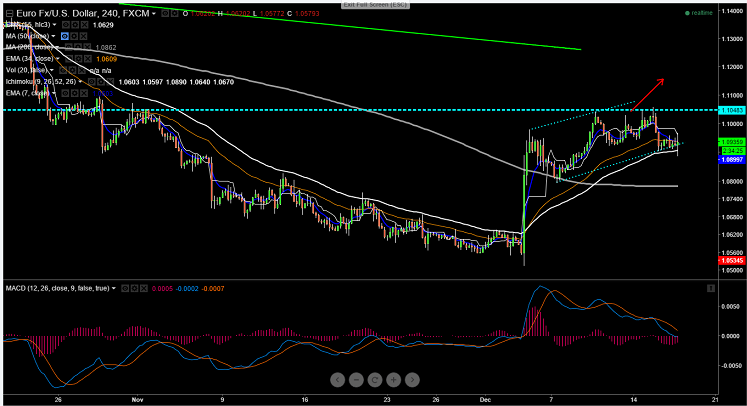

- EUR/USD has declined till 1.08879 after Fed hikes interest rate by 25bpbs. But the pair has recovered after Fed said monetary policy stance is accommodative (rates to be hiked at very slow pace)

- The pair is expected to gradually increase till 1.1000/1.10600 ins short term. Minor support is around 1.0880 and weakness can be seen below that level.

- Any break below 1.0880 will drag the pair till 1.0830/1.0780.

- On the higher side resistance is around 1.0970 and any indicative break above will take the pair till 1.100/1.10600/1.1100.

- Overall bearish invalidation only above 1.1100.

It is good to buy at dips around 1.0904 with SL around 1.0880 for the TP of 1.106/1.1100

GBPJPY Bulls Dominate: Holds Above 213 with Eyes on 215 Breakout

GBPJPY Bulls Dominate: Holds Above 213 with Eyes on 215 Breakout  EUR/JPY Powers Higher for 2nd Day — Bulls Charge Toward 187+ Breakout

EUR/JPY Powers Higher for 2nd Day — Bulls Charge Toward 187+ Breakout  FxWirePro: GBP/AUD extends losses after RBA rate hike

FxWirePro: GBP/AUD extends losses after RBA rate hike  FxWirePro- Woodies Pivot(Major)

FxWirePro- Woodies Pivot(Major)  AUDJPY Smashes 30-Month Peak — Buy the Dip, 112 in Sight

AUDJPY Smashes 30-Month Peak — Buy the Dip, 112 in Sight  FxWirePro-Major European Indices

FxWirePro-Major European Indices  FxWirePro: GBP/NZD remains weak, eyes 2.2550 level

FxWirePro: GBP/NZD remains weak, eyes 2.2550 level  FxWirePro: EUR/AUD bearish as RBA hike boosts Australian dollar

FxWirePro: EUR/AUD bearish as RBA hike boosts Australian dollar  FxWirePro- Woodies Pivot(Major)

FxWirePro- Woodies Pivot(Major)  FxWirePro: GBP/USD regains upwards momentum but unable to hold above 1.3700 level

FxWirePro: GBP/USD regains upwards momentum but unable to hold above 1.3700 level  FxWirePro- Major Pair levels and bias summary

FxWirePro- Major Pair levels and bias summary