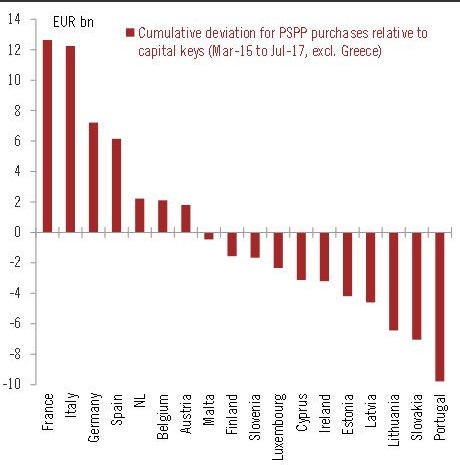

When the European Central Bank (ECB), the latecomer in the Quantitative Easing (QE) program announced its Public Sector Purchase Program (PSPP) in 2015, it was said that the program would follow the central bank’s capital key structure. The structure is based on individual countries or central bank’s contribution to European Central Bank’s (ECB) base capital. However, in reality, after years of PSPP, the deviation from key capital ratio is quite large and the gap is likely to grow if ECB continues further on its bond buying program.

According to data, while ECB bought more bonds than key capital for Italy, France, Germany, Spain, Netherlands, and Belgium, it has bought lesser amounts than the key capital for rest of the Eurozone. ECB didn’t buy any Greek bonds. The gap is highest for Franc and Italy with around €12 billion. And on the downside, the gap is largest for Portugal (approx. €10 billion).

The gap could continue for many economies and even expand if ECB continues to expand its balance sheet without changing the current rules. To give an example, as of now, ECB has bought €10 billion less of Portugal bonds than key capital ratio requires but the current bond purchase has already hit 30 percent issuer limit, whereas the rules bar ECB from buying more than 33 percent bonds for any issuer.

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed