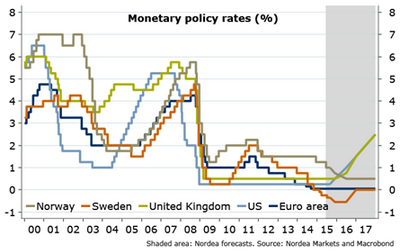

The ECB started to buy public sector bonds in March this year and intends to do so at least until September 2016. As it is seen, inflation by then will not be close enough to the 2% target and inflation expectations will not yet be "well anchored". Therefore, the ECB is expected to go on buying assets beyond September 2016.

"A half-year extension of the programme combined with an additional tapering period looks like a rather good first guess of how the purchase programme could evolve beyond September 2016. We expect the main refi rate to remain unchanged at 0.05% over the forecast horizon and the deposit rate to stay unchanged at -0.20%. For the next few months, the risk to our no-change baseline call is tilted towards more stimulus from the ECB", says Nordea Bank.

ECB to support recovery for long time

Wednesday, September 9, 2015 5:49 AM UTC

Editor's Picks

- Market Data

Most Popular

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022