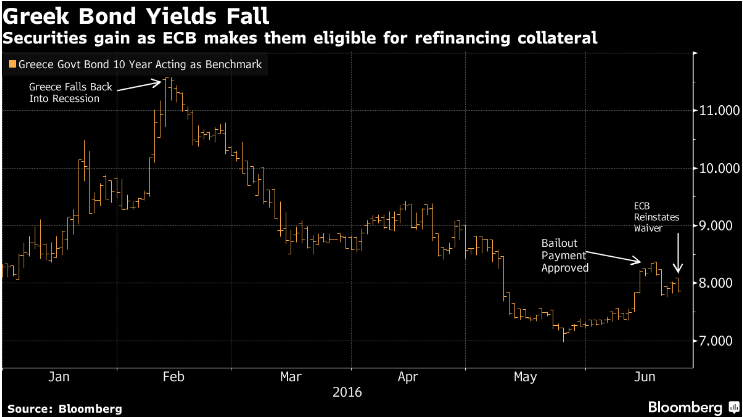

At a meeting in Frankfurt, the European Central Bank's governing council reinstated the waiver that allows Greek sovereign bonds to be accepted as collateral for regular auctions of ECB cash, despite their junk rating. The waiver would come into force on June 29th. Greek officials are also cautiously optimistic that the governing council will in September approve the country’s entry to the bank’s quantitative easing programme (QE), which would boost the government’s chances of regaining access to international capital markets.

“The governing council acknowledges the commitment of the Greek government to implementing current [bank rescue fund] programme and expects continued compliance with its conditionality,” the ECB said.

The ECB had in May 2010, granted Greek banks a special waiver to allow them to use Greek sovereign bonds as collateral, despite their junk status. However, Greek Prime Minister Alexis Tsipras and his radical Syriza party stormed to power in January 2015, threatening to rescind on the terms of its international bailout. The ECB has since stopped accepting Greek sovereign bonds as collateral on signs that Greece could fall out of its bailout programme. The Greek banks were as a consequence forced to rely on more expensive emergency lending by the central bank of Greece.

However, the shift back to borrowing from the ECB is a positive development for Greek banks. With the decision to reintroduce the waiver for Greece from June 29, the ECB is effectively welcoming Greece back into the fold of fully-fledged eurozone borrowers and lowering the borrowing costs for Greek banks.

Greece’s 10-year bonds advanced for the first time in three days, while the yield on notes due in July 2017 slid to the lowest in two weeks. Greece’s 10-year bond yields fell 11 basis points, or 0.11 percentage point, to 7.89 pct and were holding at 8.002 pct at 1145 GMT.

“Greece showed more willingness for compromise this time and the creditors did not want to have additional headline risk, given the Brexit referendum. In case there is no Brexit, I would expect more demand for Greek government bonds,” said Daniel Lenz, a market strategist at DZ Bank AG in Frankfurt.

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal