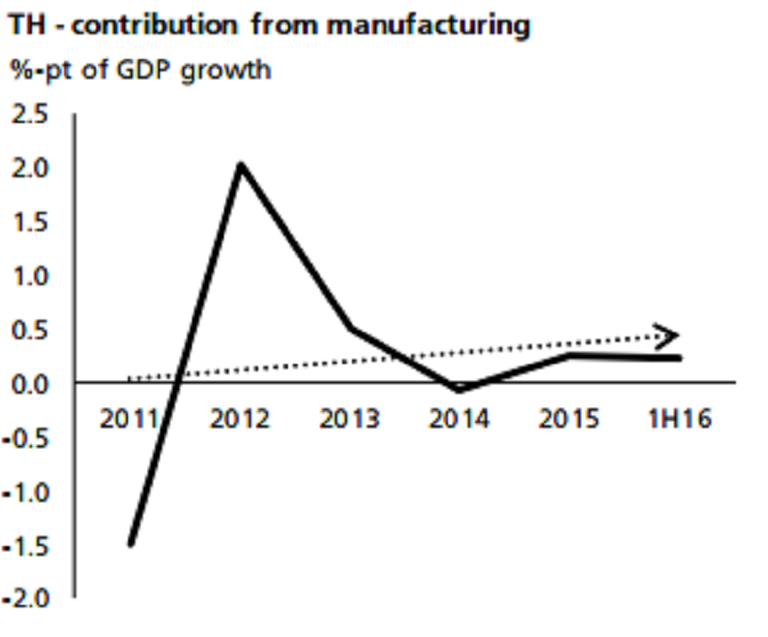

Downside risks continue to hover around Thailand’s gross domestic product (GDP) growth following the drag on the country’s manufacturing sector. While it accounts for almost 30 percent of GDP, contribution from manufacturing came in a mere 0.25 percentage point in 1H16. That is equivalent to slightly over 7 percent of overall GDP growth.

Any improvement since 2014 has been limited and it is not hard to explain why. Exports are likely to contract again this year, keeping capacity utilization some way off from its normal level. A quick look at the balance of payments also suggests that more Thai companies have been stepping up on their overseas investment.

It is crucial to see a sustained recovery in the sector before we get more upbeat on the economy’s overall growth potential. Manufacturing employs about 16 percent of the workforce. Coupled with the similarly weak agriculture sector, it is little wonder that wage growth is trending at a mere 2 percent annual pace. GDP growth may remain stuck in the 3-3.5 percent range for longer than initially expected.

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains