Bank of Japan (BOJ) ambitious easing has so far failed to achieve targeted inflation path as consumers have scaled back their purchase after sales tax hike of 2% and now latest earnings data released today, show that ambition may remain out of reach as wages are hardly growing.

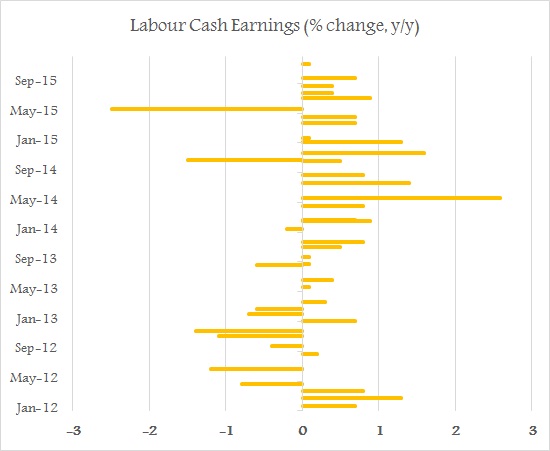

Labour cash earnings reported wages only edged up by 0.1% in December, compared to level a year ago. So economists are posing a serious question - if economy is growing just about 1.6% y/y and inflation is hovering at near zero level, why should companies pay higher wages, more so for firms, focused into domestic market, who are not major beneficiaries of weaker Yen. Bank of Japan's (BOJ) selective buying into equities, are not large enough to compensate corporations to increase wages.

Figure shows, increase in Labour earnings were quite visible and had strong momentum back in 2013/14 but has become more subdued as global growth weakens.

As early as last month, BOJ had introduced negative rates on excess reserve but the current three tier system adopted by BOJ leaves enough wiggle room for banks and total deposit unlikely to earn a net negative until the very late.

Moreover, with negative rate introduction, it is more likely that BOJ would adjust in that front, rather than to boost purchase.

Yen is currently trading at 117.2 per Dollar, much stronger than 125 level seen last year.

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence