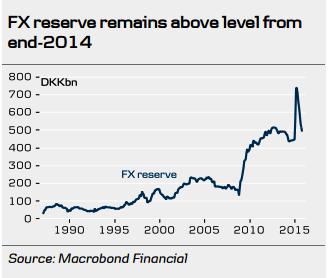

In October, Denmark's FX reserves declined to DKK492bn, from DKK514bn in September. DKK10bn of the decline was due to DN purchasing DKK in FX intervention.

The remainder was due to repayment of government foreign debt. Since April, DN has purchased DKK in FX intervention for DKK223bn, which has brought the FX reserve closer to the level from last year of around DKK450bn.

However, the pace of FX intervention slowed in October compared with September, where FX intervention totalled DKK22bn. The ECB is likely to cut its deposit rate by 10bp to minus 0.30% and expand its bond purchase programme to DKK75bn at its next meeting in December.

"DN might keep all its policy rates unchanged, i.e. the rate of interest on certificates of deposit is likely to stay at minus 0.75%, the current account rate at 0.00% and the lending rate at 0.05%", added Danske Bank.

Denmarks Nationalbank likely to stay on hold

Wednesday, November 4, 2015 4:04 AM UTC

Editor's Picks

- Market Data

Most Popular

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX