Dollar index trading at 95.99 (-0.48%)

Strength meter (today so far) - Aussie -0.09%, Kiwi +0.56%, Loonie +0.28%.

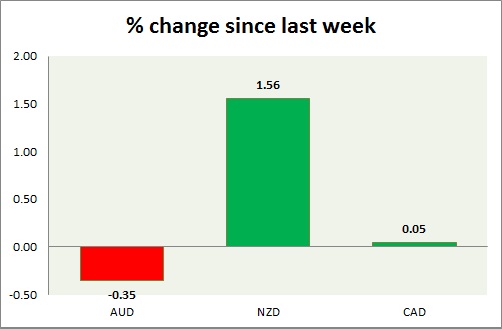

Strength meter (since last week) - Aussie -0.35%, Kiwi +1.56%, Loonie +0.05%.

AUD/USD -

Trading at 0.734

Trend meter -

- Long term - Sell, Medium term - Range, Short term - Range/Sell

Support -

- Long term - 0.60, Medium term - 0.71, Short term - 0.71-0.715

Resistance -

- Long term - 0.87, Medium term - 0.83, Short term - 0.78, Immediate - 0.75

Economic release today -

- NIL

Commentary -

- Aussie remains sell due to tensions in China. Active call - Sell Aussie with stop around 0.785 and 0.825 to target 0.715, 0.70 and 0.65.

NZD/USD -

Trading at 0.663

Trend meter -

- Long term - Sell, Medium term - Range/sell, Short term - Range

Support -

- Long term - 0.653, Medium term - 0.65, Short term - 0.65

Resistance -

- Long term - 0.78, Medium term - 0.75, Short term - 0.70, Immediate - 0.68

Economic release today -

- NIL

Commentary -

- Kiwi is the best performer and rose further today as FOMC was more dovish than expected.

USD/CAD -

Trading at 1.309

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Buy

Support -

- Long term - 1.17, Medium term - 1.217, Short term - 1.265

Resistance -

- Long term - 1.32, Medium term - 1.315-1.32, Short term - 1.32

Economic release today -

- Whole sales rose by 1.3% in June.

Commentary -

- Weaker oil price creating headwinds for loonie along with slowdown in manufacturing. Loonie is likely to slide towards 1.38 against Dollar, as oil prices selloff continues.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings