Dollar index trading at 100.01 (-0.24%)

Strength meter (today so far) – Aussie -0.31%, Kiwi +0.01%, Loonie +0.17%

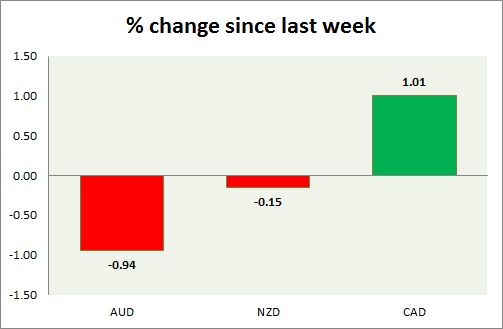

Strength meter (since last week) – Aussie -0.94%, Kiwi -0.15%, Loonie +1.01%

AUD/USD –

Trading at 0.747

Trend meter –

- Long term – Range, Medium term – Sell, Short term – Buy

Support –

- Long term – 0.683, Medium term – 0.72, Short term – 0.73

Resistance –

- Long term – 0.782, Medium term – 0.765, Short term – 0.765

Economic release today –

- Unemployment rate for October came at 5.6 percent. Net employment rose by 9,800.

Commentary –

- The Australian dollar likely to go for a larger correction. Active call – Buy AUD/USD at 0.752 and at dip with the stop loss at 0.71 and the target at 0.82

NZD/USD –

Trading at 0.709

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Buy

Support –

- Long term – 0.66, Medium term – 0.69, Short term – 0.69

Resistance –

- Long term – 0.8, Medium term – 0.76, Short term – 0.73

Economic release today –

- Retail sales report for third quarter will be released at 21:45 GMT, along with producer price index.

Commentary –

- The kiwi is trying to form a base around 0.7 area. We expect kiwi to rise towards 0.81 area.

USD/CAD –

Trading at 1.34

Trend meter –

- Long term – sell, Medium term – buy, Short term – Range/buy

Support –

- Long term – 1.248, Medium term – 1.25 , Short term – 1.25

Resistance –

- Long term – 1.38, Medium term – 1.345, Short term – 1.345

Economic release today –

- NIL

Commentary –

- Loonie continues to outperform as the oil price remains well bid in the hope of a deal. We expect the loonie to reach 1.375 and 1.4.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022