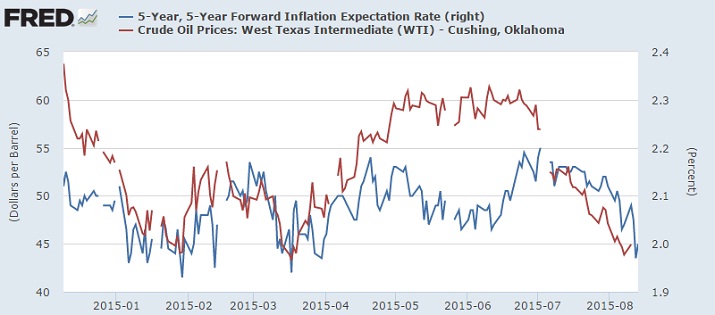

US crude benchmark WTI, last week dropped to new 6 year low resulting in deterioration of inflation expectation among investors.

Last week US inflation expectations, as measured by 5y-5y forward inflation expectations dropped below 2% for first time since March. In March, WTI dropped to $42/barrel and last week it has broken that low to trade as low as $39.5/barrel, before bouncing back sharply.

Though US Federal reserve looks at core price rise that excludes volatile components, such as food and energy, lower oil price is likely to sip in to core components too, which might lead to much slower pace of hike than anticipated, even by FED's own officials.

As of latest data from FRED, 5y-5y forward inflation expectations is hovering around 2%, down from its recent high in July of 2.2% and WTI is trading at $42/barrel.

With crude hovering at such low, possibility is extremely high that FED will sound very dovish, in spite of a rate hike in September.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand