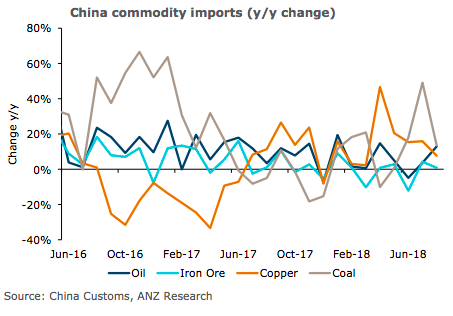

China’s imports is expected to moderately decline in months ahead owing to higher inventories in the country, according to the latest report from ANZ Research, after the release of the country’s trade balance data for the month of August.

China’s imports for August were strong, defying expectations of weaker demand amid the ongoing US-China trade tension. Most of the major commodities recorded both a m/m and y/y gain, suggesting domestic demand remains strong. The pick-up in imports is all the more impressive considering it has occurred despite a depreciating currency.

With China taking a more proactive fiscal policy stance, we expect imports of commodities to remain robust for the remainder of the year despite any ongoing trade tension. Oil demand from independent refiners rebounded strongly in August as rising fuel prices and improved margins saw many refiners ramp up their purchases following summer maintenance.

This pushed August’s oil imports to three-month high. LNG imports remained strong, rising by 37 percent y/y in August. They are now up 35 percent in the first eight months of the year as authorities continue to encourage the use of the cleaner burning fossil fuel. Ongoing curbs on steel production dampened iron ore demand, with imports up only 0.8 percent y/y.

However underlying domestic demand appears to be strong, underlined by strong growth in copper imports (+7.7 percent y/y). And disruption to trade due to US sanctions on Russia continues to benefit Chinese aluminium exporters, with volumes rising 26.1 percent y/y in August, the report added.

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran