House prices in China's largest cities in January rose marginally to 64.3 percent, the lowest rise in the last 12 months, data from the National Bureau of Statistics showed Wednesday. Out of the 70 cities analysed by the agency, on a monthly basis, house prices climbed 45 cities while it fell in 20 cities and remained flat in 5 cities. Prior data shows prices increased in 46 of the cities in December and 55 of them in November. The figures show a gradual cooling of China's new housing sector.

"Monthly growth in the country's 15 first-tier and major second-tier cities has slowed down and house prices have stabilized as local governments' tightening measures have taken effect," said NBS statistician Liu Jianwei.

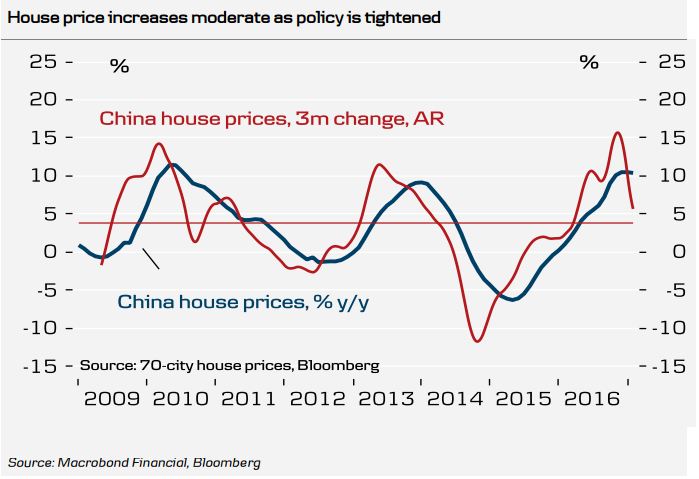

Growth in the 70-city house price index fell to 5.7 percent measured on the 3-month annualised rate. This is down from the peak of 15.7 percent in November last year. Growth in the 70-city house price index fell to 5.7% measured on the 3-month annualised rate. This is down from the peak of 15.7% in November last year. Experts believe that the real estate scenario in China is uneven, registering strong demand in main cities and excess supply in smaller towns.

China's property market in major cities has continued to stabilize after authorities took a series of measures to contain rising prices. China house prices in December saw the first deceleration in year-over-year housing price growth after 19 months of continued acceleration. Subsequently, data reported on Wednesday showed that after its November peak, January house prices decelerated again.

The People's Bank of China (PBoC) in the Q4 monetary policy report released on 18 February stated that it would “strictly limit the flow of credit into speculative housing purchases”. The real estate market played a big part in China's economic growth in2016. A further moderate cooling of the housing market this year could likely put a brake on Chinese growth. That said, low residential inventories should avoid a sharp downturn in both house prices and construction activity.

PBOC set USD/CNY central rate at 6.8695 on Wednesday (vs. yesterday at 6.8830). USD/CNY was largely range bound on the day, trading at 6.8761 at around 1030 GMT. FxWirePro's hourly strength index at the same time showed USD hourly strength index was at -22.0912 (neutral) while CNY hourly strength was at -64.339 (bearish). For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens

Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran