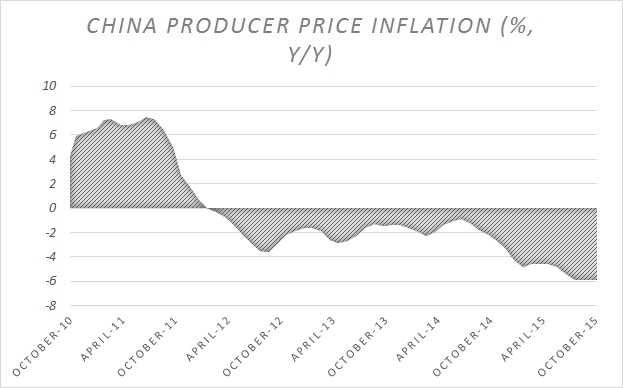

Wind of deflation seems just not ready to leave China. At one hand, China's producer price index failed to grow in November, while producer prices remained in deflation, just a quarter shy of four years. Producer price has been deflating at -5.9% y/y since August. This time economists were expecting it to worsen to -6%.

While lower oil and commodity prices are contributing to lower prices from producers, demand is also one of the key reasons.

A recent report, Chinese firms are continuing their production, especially industrial and capital goods such as steel, so that the unemployment doesn't deteriorate. Producing below cost curve might also be contributing to the deflation.

Since China is world's largest exporter, it is just exporting its deflation around the globe.

After today's report, there would be further speculation that People's Bank of China (PBoC) will ease policy further. Since late last year, PBoC has reduced rates six times, but interest rate being at 4.35% and inflation target around 3%, PBoC has way more room to cut.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed