China’s growth momentum is expected to lose steam over the coming months, especially in the second quarter of 2017 as the stimuli that helped in the process of a slight economic recovery is likely to fade out in the near term.

A fiscal stimulus via infrastructure investments, a rebound in the construction sector due to strong home sales and reduction in home inventories amid a moderation in exports, supported by a 10 percent weakening of the CNY that boosted the country’s performance in the past few months, are all expected to fade out going into 2017, Danske Bank reported.

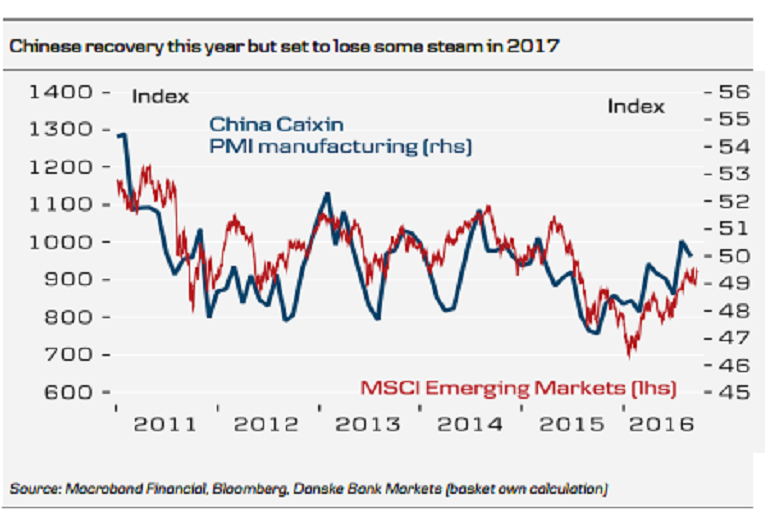

Chinese growth indicators continue to support the case for a moderate recovery this year. PMIs have trended higher and industrial production and profits have rebounded too. Indicators for electricity production and steel production confirm this.

In addition, monetary policy is expected to be on hold for the rest of this year but may witness a resumption of easing during the second quarter of 2017 as the cycle loses some steam. However, fiscal policy is the preferred tool for now as the government is concerned over rising leverage in the financial system and regional housing bubbles. The government has already indicated a further fiscal easing in the second half but not how much.

"We believe the fiscal growth impact will on average be slightly smaller in 2017 versus 2016. Also, we look for a continuation of the weakening trend of the CNY, not least versus the EUR where we expect a 10 percent depreciation +12M," the bank commented in its research report.

However, stock markets can be expected to remain more challenged in 2017 as growth momentum fades a bit again.

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed