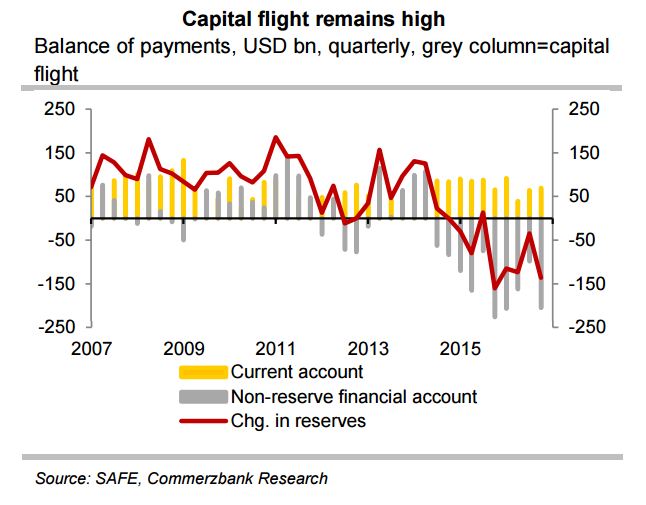

China's foreign exchange reserves unexpectedly fell below the crucial $3 trillion level in January for the first time in nearly six years despite efforts by authorities to curb outflows by tightening capital controls. The speed at which the country is depleting its foreign exchange reserves is highlighting the nation's unsustainable current currency policy.

Unless the Chinese authorities are able to encourage more foreign inflows, there is likely to be further capital outflows in the near term. Data has raised concerns among analysts that continued outflows will prompt the Chinese authorities to devalue their currency. To maintain stability in the RMB Index the PBoC will have to allow the RMB to adjust more freely, which would mean letting it weaken further.

China may be nearing the point where a significant devaluation of the currency would become necessary. However, there are reasons why the authorities would want to avoid a sharp weakening of the yuan anytime soon. Global debate on currency manipulation has seen a resurgence. The U.S. trade adviser has recently blamed Germany for benefiting from a weak euro and Trump himself has previously criticized Japan and China for having a weak exchange rate.

A sharp bilateral weakening would provide the Trump administration with the ammunition to declare China to be a “currency manipulator” and impose trade or investment-related sanctions. The authorities will do everything they can to avoid a hard yuan landing before the party congress.

"In our view controlled depreciation will remain the central issue for CNY for the foreseeable future. We expect USD-CNY to trade at 7.15 in late 2017 and 7.40 in late 2018," said Commerzbank in a report.

PBOC today set Yuan mid-point at 6.8710/dollar vs last close 6.8715. USD/CNY made intraday high at 6.8710 and low at 6.8613 levels. Intraday bias remains slightly bullish. A sustained close above 6.86 marks will test key resistances at 6.8823. Alternatively, a daily close below 6.86 will drag the pair down towards key support at 6.8550.

FxWirePro's Hourly USD Spot Index was at 111.641 (Highly Bullish), while Hourly CNY Spot Index was at -158.554 (Highly Bearish) at 1215 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility