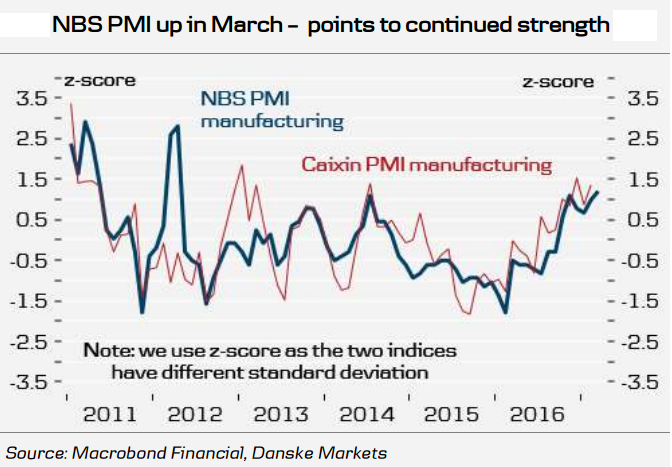

Chinese official manufacturing Purchasing Managers' Index (PMI) continued strength in March, adding to evidence that the world's second-largest economy is gaining momentum early in the year. The official PMI rose to 51.8 in March from the previous month's 51.6.

China March factory activity grows fastest in nearly five years which points to still strong growth at the end of Q1. The reading was stronger than the 51.6 that economists had expected and the highest since April 2012. China's private Caixin PMI manufacturing is due to be released on Monday and analysts expect this is likely to paint a similar picture.

The export orders index was seen as the biggest contributor, with the export orders index rising from 50.8 to 51.0, the highest level since 2012. Stronger global economy and weaker CNY exchange rate provided strong support to the export sector. But concerns remain that a more protectionist trade stance under U.S. President Donald Trump could jeopardise a recent revival in China's exports.

The overall new orders index also showed improvement, rising to 53.3 from February's 53. Highlighting the strength of the building boom, a measure of the construction industry stood at 60.5, compared to 60.1 in February.

"We expect the People’s Bank of China (PBoC) to embark on further tightening to cool the housing market, as this is the main concern in China today, together with the rising leverage in the financial system. We believe the PBoC will continue tightening until it sees visible signs that housing is slowing. Investment plans and electricity generation are two of the indicators that suggest softer growth," said Danske Bank in a report.

Authorities in China are counting on growth in services and consumption as they look to rebalance the country's economic growth model from a heavy reliance on investment and exports. China's official non-manufacturing Purchasing Managers' Index (PMI) rose to 55.1 in March, the highest since May 2014 and up from the previous month's 54.2.

"With continued strength in China, emerging markets assets and global risk sentiment continue to get support from this front. Some moderation in PMI in coming quarters should weaken the picture but not cause great turmoil," adds Danske Bank.

The Chinese yuan slipped despite higher than expected manufacturing PMI, non-manufacturing PMI data. USD/CNY made intraday high at 6.9025 and low at 6.8869 levels. PBOC sets Yuan mid-point at 6.8993/dollar vs last close 6.8886. FxWirePro's CNY spot index was neutral at -41.001 at around 1030 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market