The risk of a hard landing this year and the next is limited because Beijing will likely do everything to prevent such a scenario. The authorities will rely on the "old growth model" with credit-fueled public investment to stabilise the economy in the short term, if necessary.

Nordea Bank says the probability for a hard landing of around 30% on 3-5 year horizon, because of the following two factors:

- The equity market turmoil could risk starting a domino effect that leads to a burst of the other two bubbles, the housing bubble and the credit bubble.

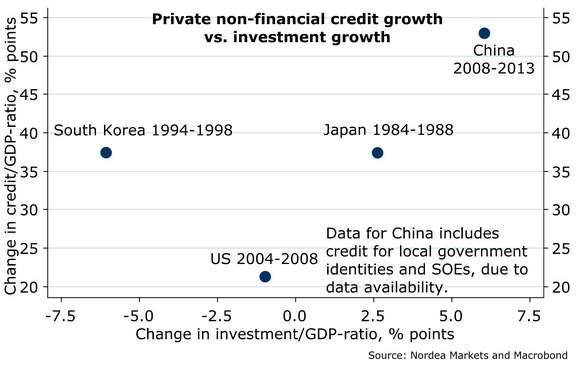

- More importantly, Beijing is taking a "whatever it takes" approach with regards to its policy response to the economic slowdown, trying to boost investment that is still dominated by public sector. Credit-to-GDP and investment-to-GDP are already high and will continue to rise. Since it is at alarming levels compared to previous crises, continuing the old growth model is clearly not sustainable. Therefore the bank sees larger probability for this bubble to burst on 3-5 years horizon.

The real concerns for the Chinese economy stem from the credit and property markets. Both are big enough to prompt a "hard landing"-scenario if deflated uncontrolled. Both have become more closely linked to the equity market.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX