China’s consumer inflation is expected to trend higher in 2018 with a 2.6 percent annual rise, supported by prices of food and services. Food prices may record an increase in 2018 on a y/y basis due to the resumption of the “pork cycle” and a low base effect in 2017, ANZ Research reported.

In fact, food inflation has edged up on an m/m basis since August 2017, recording 1.1 percent in December. In addition, services inflation should retain a strong uptrend, benefitting from good demand.

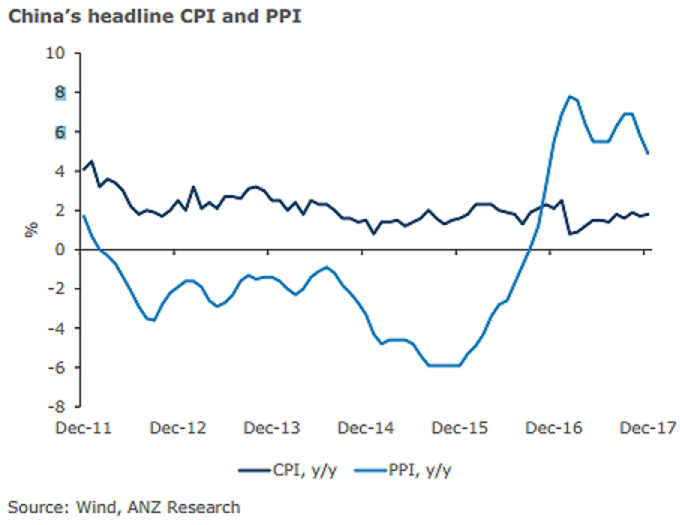

China’s inflation momentum picked up in December as both PPI and CPI registered sequential increases. Food prices, which fell 1.4 percent y/y, were the major pullbacks to the headline measure in 2017 on a y/y basis. The prices of consumer goods in the PPI basket edged higher only by 0.7 percent y/y in 2017, mirroring the sluggish CPI. On the other hand, prices of production goods boosted the PPI, thanks to strong price movement in commodities, such as steel and coal.

China’s capacity reduction programme for steel and coal will likely be completed in 2018 and extended to other sectors. Producer prices will continue to hold up. The Chinese authorities recently issued a document to the steel, cement, and glass industries, reinforcing curbs on output and displaying strong political will.

"Apart from the deleveraging campaign, the inflationary outlook supports our call for a further upward adjustment in the open market operation rate by 35 basis points in 2018. We also expect the 10-year government bond yield to reach 4.35 percent by the end of the year," the report added.

Meanwhile, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market  Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens

Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX