Earlier this month, the People´s Bank of China announced that it would begin to calculate and track the value of RMB versus a basket of currencies instead of just the US dollar. On 11 December, the PBoC posted an editorial on its website from the China Foreign Exchange Trading System with the details of a new official trade weighted index. The announcement was a "significant event," and sent a strong signal to investors to shift their focus to its basket measure of the currency from the USDCNY rate.

Worth noting was a statement from the authorities that though RMB has depreciated against USD this year, it has appreciated modestly on a TWI basis - increasing speculation that more upside in USD/RMB may be in store. The statement suggests the possibility that the Chinese authorities may allow for a gradual depreciation of the CNY (and CNH) versus the USD since the trade-weighted CNY is very strong from a historical perspective and has substantial room to depreciate versus the USD.

"We don't disagree that RMB is likely to continue weakening through 2016, we think the timing is not right to add to USD/CNH longs. Rather, we think there is scope for a squeeze lower in USD/CNH into year-end", says Morgan Stanley in a research note.

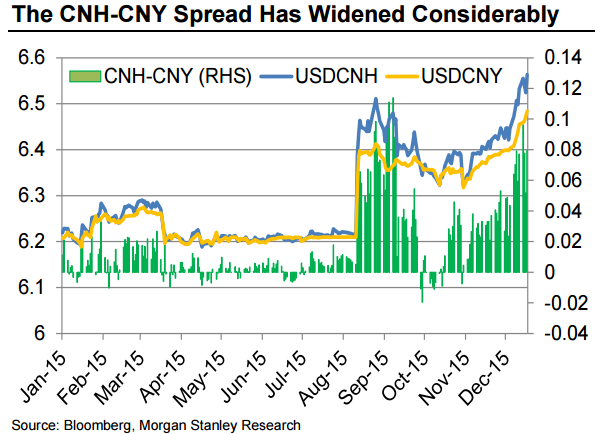

Financial conditions in China were tightening too quickly on broad-based USD strength. The CNH-CNY spreads have also widened substantially, encouraging further capital outflow, which adds to tightening financial conditions. This increases the probability that authorities will use thin liquidity in a one-way positioned market to tighten the offshore-onshore spread. This may also push higher the cost of holding CNH shorts, further discouraging speculation in the market.

"We forecast medium-term RMB weakness, we suggest caution on CNH short positions into the end of the year", adds Morgan Stanley.

China's yuan barely moved against the dollar on Thursday. The spot market CNY opened at 6.4780 per dollar and was changing hands at 6.4784 at midday, almost unchanged from the previous close. The offshore yuan CNH was trading 0.9 percent weaker than the onshore spot at 6.5370 per dollar.

Caution suggested on CNH short positions into the year-end

Thursday, December 24, 2015 10:10 AM UTC

Editor's Picks

- Market Data

Most Popular

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand