We suggested in our previous post that Brexit pose both risks and opportunity for pound traders. With pound being hammered to five year low, significant opportunity exists either buying it or selling it. But for traders to do whatever they want to...two of the key question need to be answered fir either of the camp.

So, as we see it - key questions are -

- Will Britons vote to leave European Union or not?

- If they do, since it is not end of world.......is market overpricing risks?

Like we said in prior posts, answer to these two questions, would decide UK's viz. a viz. Pound's fate in the coming years.

So how likely is that Britons would vote for an exit from Euro area?

The answer to this question, even if not totally but largely depends on answer to another question - How UK's political group would campaign for the agenda - will they be Pro-EU or anti EU. As of now, all parties and their members are free to campaign as they like...however, their attitude would totally depend on answer to another question - Will an agreement be reached between UK and EU - which would satisfy UK's political class.

As of now it seems, a deal is most likely to get reached in February, with most European Union countries would want Britain to stay in EU. However, there are still some issues left to be chalked out especially the stand-off regarding migrants. Mid-last year, we have been suggesting with European migrant crisis - Brexit would come into focus.

Whether a deal is reached or not, it is sure to be a tense moment as people tends to be largely unpredictable, while voting.

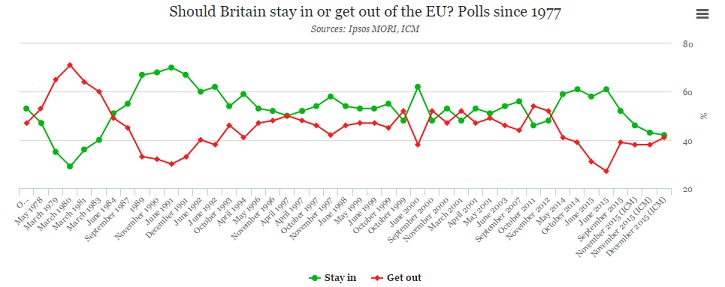

The above figure from, Highcharts.com and Telegraph of UK, shows exactly why it could be a tense moment. While back in June, 2015, according to poll, 61% Britons were likely to vote for a stay in EU but thanks to intensify in influx of migrants from war torn regions of Syria, Afghanistan, Balkan province might have soured the mood.

While UK has been repellent to migrants, Germany has open door policy. EU enforced quota system for all of its members led by Germany and France. As migrant crisis intensified, more Britons are now prepared to opt out of EU.

As of December poll, conducted by ICM, 41% of Britons want to vote out of EU, while 42% wants to stay.

So unless things change from now to the vote, it is likely to be close call. Despite knowing that a stay vote could be positive for pound, taking directional position remains any body's wild guess.

However, we at FxWirePro, are probably bunch of optimists and expect a 'NO' vote. Seriously speaking, we remain somewhat confident, EU deal would get reached and Mr. Cameron would be able to sell it well.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX