The Bank of Japan (BoJ) concludes its two-day policy meeting on Tuesday, 20t December. The central bank is widely expected to keep its benchmark interest rate unchanged at -0.10 percent and is also likely to leave the yield curve control parameters unchanged. Main focus will be on the BoJ’s economic forecasts.

JPY weakened significantly against the dollar after Trump's surprise victory at 2016 U.S. Presidential election in November. A weaker yen makes Japanese exporters more competitive and makes the country a more attractive destination for tourists, which bodes well for the economy in 2017.

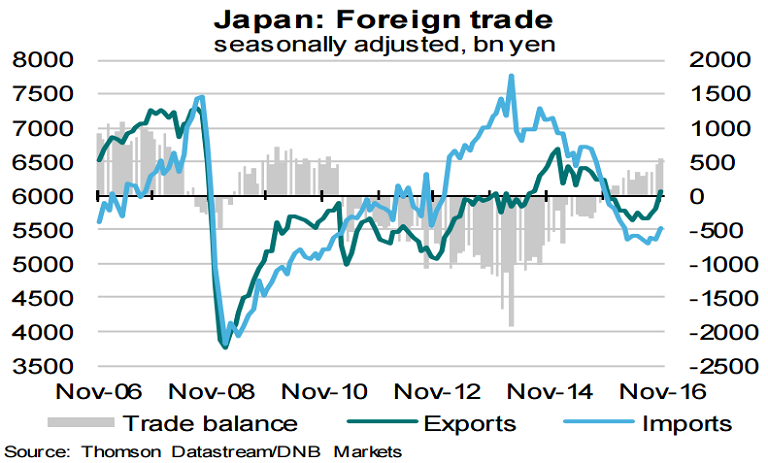

November's goods trade report released on Monday suggested that Japan is on a more solid footing. Data showed Japan's export volume rose at the fastest pace in nearly two years in November, boosted by demand from China. Overall, export volume rose 7.4 percent in November from a year earlier. Higher commodity prices and weaker yen were seen pushing up trade values.

The BoJ's Tankan signalled ongoing expansion in Q4, with manufacturers in particularly more upbeat about conditions. While firms remained downbeat about price expectations, inflation is set to pick up over coming months. Data suggested that the world's third-largest economy is on a steady growth track.

The economy expanded modestly in each of the first three-quarters of 2016, and economists expect something similar in the fourth quarter. Upbeat data add to the likelihood that the BoJ will raise its assessment of Japan's economy, including export demand, at its regular two-day policy meeting on Tuesday. Moreover, the BoJ is also expected to keep its inflation and economic growth forecast unchanged until it achieves the target range.

JPY strengthens as we head into the BoJ policy meeting. USD/JPY was trading 0.59 percent lower on the day at the time of writing at around 11:30 GMT. Technical studies remain bearish intraday. The major has taken support by 5-DMA support at 117, break below likely to target 116 levels. Further weakness could see test of 114.80.

FxWirePro's Hourly USD Spot Index was at 114.069 (Highly bullish) and Hourly JPY Spot Index was at 104.075 (Highly bullish) at 11:30 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell