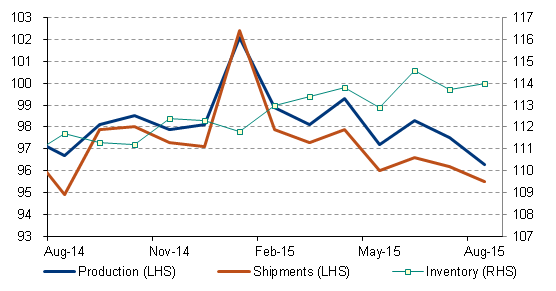

The BoJ's next Monetary Policy Meeting is on 30 October. The meeting will be a one-day affair, at which the central bank is scheduled to update its semiannual Outlook Report and revise its outlook on the economy and prices. Based on recent export volumes and industrial production data.

"We think Jul-Sep real GDP growth is likely to be quite low around 0%, with any gains likely to be very small. In addition, the crude oil prices continue to move up and down in a narrow range that remains below the level assumed in the BoJ's CPI forecast. Consequently, we think the BoJ could cut its FY15 real GDP forecast again from the 1.7% announced in July to below 1.5%, and slightly lower its 0.7% forecast for price inflation", says BofA Merrill Lynch.

Meanwhile, economists see a wide divergence in market views on the likelihood of a BoJ decision in favor of additional easing at Friday's meeting. Indeed, it is difficult to get a good reading on the likelihood of such a decision as August CPI excluding the energy factor indicates a continued improvement with unemployment at its lowest level (3.4%) since August 1997, while uncertainty exists about the length of economic slowdowns in the US, China, and Japan as well as the impact on inflation expectations.

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022