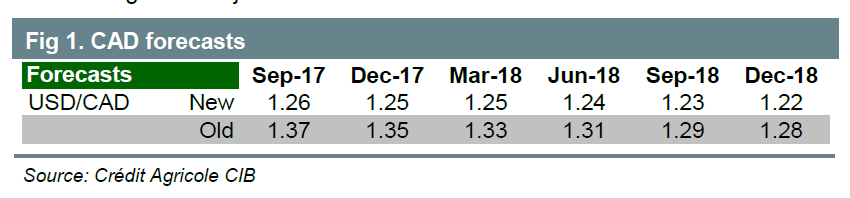

The Bank of Canada embarked on its first policy tightening cycle since 2010 a week ago, affirming and expanding the current bounce back in the CAD. The provoke begin to the BoC's tightening campaign – nine months earlier than we had been expecting and 15 months earlier than was priced into the market as of late as May – warrants a significant upward revision to our USD/CAD figure.

This is particularly so, as general notion on the USD has gotten worse. All things considered, the CAD as confronting some near-term risks, including lower domestic inflation, a quickly cooling housing market, US protectionism and occasional global risk jitters.

At its July meeting, the BoC spelled out the reasons for the start of policy tightening: growth has been robust, huge economic slack has been retained, the adjustment to lower oil prices is largely complete and the extreme level of accommodation introduced in response to the oil-price shock is no longer required.

Also, inflation is judged to be low for the most part in light of "temporary components" and the BoC must be guided by future instead of current inflation. As the output gap is expected to close by the end of 2017, this warrants beginning policy tightening now to abstain from getting behind the curve in 2018.

Crédit Agricole CIB added that the BoC’s shift has generated a dramatic adjustment in the CAD over the past month, amplified by the market being positioned short the currency. The short answer is that the BoC appears to have a high confidence in their models that suggest that the closing of the output gap will generate inflation.

Some of the BoC’s own recent research has suggested that weak wage growth in Canada has been due mainly to cyclical factors, such as slack, as well as low commodity prices, compared to the US where weak productivity growth has been the dominant factor. As slack is eliminated and with commodity price adjustment now complete, the BoC believes wages and inflation will pick up, said corporate and investment banking entity.

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out