After Bitcoin’s price spike on the 29th of June which surged from $5,780 to the current $6,305 levels, prices haven’t changed much. Over the past 24 hours, BTC’s lowest has been $6320 with the peak being $6430. If you’re perplexed when it comes to the pioneer cryptocurrency trend, remember, you’re not the only one for this perplexity. The rapid and stratospheric spike of bitcoin prices towards $20K and its jerk to tumble back to $6k level is all a little dizzying and dramatic.

However, we explicitly illustrated this perplexity referring to a concept called “booming cycle” of the price of BTCUSD back in December in our previous post, please refer below weblink for further reading:

When you bought a single bitcoin within the range of around $750-$1000 just a year ago is now worth $10,000, then how would you probably spend it? This is just one side of perspective view.

On the contrary, an aggressive investor’s the same single bitcoin worth $20K just six months back has now become $9,333, isn’t this puzzling?

But never forget, after shedding billions of dollars for several months, the price of Bitcoin seems to be stabilized between $5,700 and $6,000 levels. Although the Bitcoin ‘boom’ that took place near the end of 2017 has veritably ended, the cryptocurrency is still as popular and controversial as ever.

Few people perceive that the crypto-assets have shown the signs of a bubble, while the market capitalization is $222 billion, 16 times as much as a year ago, with no significant change in tangible economic value. Currently, we see less bearish sentiment than the sentiment during the beginning of this year, a trajectory where the sentimental data is aggregated that was gathered in the recent past from various walks of life who are related to specific projects and tokens. These people would be developers, investors, traders, skeptics and journalists alike from various parts of the world. These comments are completely opinionated and conclusions are a summary of the interviewed respondents.

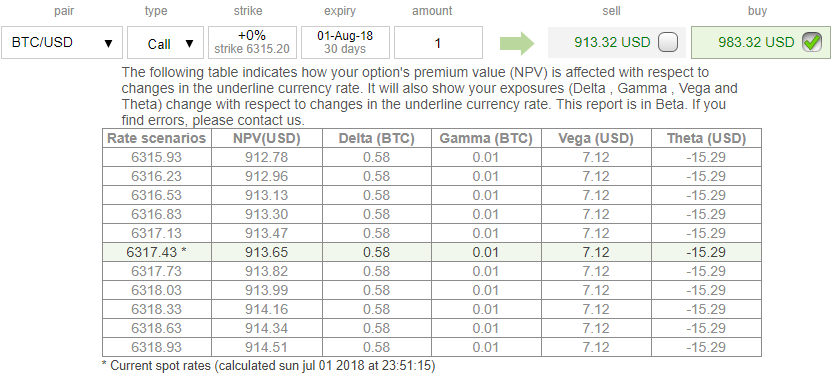

If you observe the 1m BTCUSD call option, these derivatives instruments are fairly priced-in comparing with the NPV (Net Present Value) with 58% delta which is conducive for hedgers. The Vega of a long (buy) option position is 7.12 USD and IV increases or decreases by 1%, the option’s premium will increase or decrease by 7.12 USD, respectively. Vega is the sensitivity of an option’s value to a change in volatility. It is usually expressed as the change in premium value per 1% change in implied volatility. Contemplating all these factors, we foresee stability in price at this price level.

Bobby Pham, a Bitcoin miner from Coventry says, “the mining business has taken a hit all over the world. Even big players like Hashflare which gave out profitable BTC mining contracts have stopped accepting fresh contracts. The December hike last year interested a lot of big players who invested millions in mining farms in colder, cheaper places. With big players in this market and billions invested in the industry, there is no way the markets are staying this way for a long time. I wouldn’t say the typical “moon” is happening soon but it is happening for sure.”

Currency Strength Index: FxWirePro's hourly BTC spot index is flashing 122 (which is bullish), while hourly USD spot index was at -61 (bearish) while articulating (at 07:05 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022