US job data on Friday (NFP) and Wednesday (ADP) has been one of the few bright spot in global doom-gloom, starting 2016. While, 2016 has been worst start so far stocks in global markets, many fear (including us) an impending recession in US, due to slowdown in activity such as factory orders, retail sales. Moreover, companies' income statement points to weakness in economy as well as in their positions.

Higher US Dollar has already been a headache for US companies, now weakness in China and emerging economies as a whole is derailing sales of US companies. Total business sales, exports, all pointing to not only further weakness but impending possibility of a recession.

Two sectors remain especially vulnerable, commodity segment (mining, energy) and manufacturing. Due to lower oil price, high yield debt of energy companies are trading at highest spread since financial crisis, whereas contraction in ISM manufacturing PMI for two consecutive months point to recession in the sector.

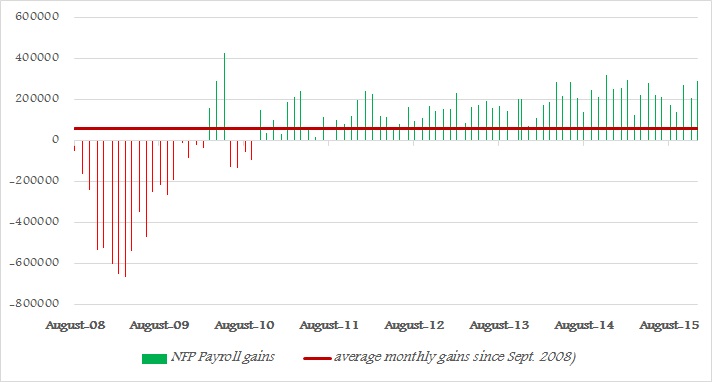

However only piece of mega good news for US economy has been improvement in labour market. Both ADP employment report and NFP came superb. According to ADP, in December, US economy added 257,000 jobs, while NFP headline number was 297,000, highest since March last year. Recent labour market data has also been pointing some signs of improvement in wage growth, though it hasn't been consistent and steady yet. Overall, despite service sector being the largest job provider, payroll gains have been broad based.

Argument is that, without signs of optimism on the horizon, companies wouldn't have hired more people, providing some hope against recessionary fears.

However, whether FED's hike path steepens due to payroll or not is a different issue altogether, since inflation has largely been absent.

Trump Extends AGOA Trade Program for Africa Through 2026, Supporting Jobs and U.S.-Africa Trade

Trump Extends AGOA Trade Program for Africa Through 2026, Supporting Jobs and U.S.-Africa Trade  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Paul Atkins Emphasizes Global Regulatory Cooperation at Fintech Conference

Paul Atkins Emphasizes Global Regulatory Cooperation at Fintech Conference  US-India Trade Bombshell: Tariffs Slashed to 18% — Rupee Soars, Sensex Explodes

US-India Trade Bombshell: Tariffs Slashed to 18% — Rupee Soars, Sensex Explodes  Japan’s Agricultural, Forestry and Fishery Exports Hit Record High in 2025 Despite Tariffs

Japan’s Agricultural, Forestry and Fishery Exports Hit Record High in 2025 Despite Tariffs